The Fastest Growing Bank You've Never Heard Of - $VBNK, You Decide

Versabank - The Little Antisocial Bank That Could Pt. 2

Disclaimer: Before we get to the fun stuff. This post is not financial advice, and not a solicitation to purchase or sell securities. You should conduct extensive research before engaging in any type of investment decision, and consult a financial advisor / tax advisor. As a reminder, this article is written by a guy impersontingg a decades old movie character online, it should not be taken seriously. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the post before making any decisions based on such information. By reading this post, you acknowledge that the opinions expressed herein may be highly inaccurate and unfounded, that this article is for informational, educational purposes only, and to indemnify and hold harmless the author (me) from any claims / actions arising from your reading / sharing of this article.

The content herein is the exclusive content of Chief’s Substack, All Rights Reserved.

The article is an expanded thesis of the original tweet

Quick Stats:

Name: Versabank ($VBNK)

Sector: Banking

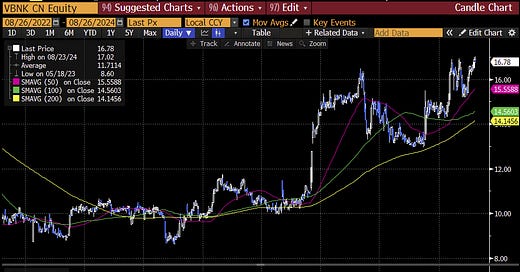

Price: $16.78 CAD

2025 PE: 6.9x

Price to Tangible Book: 1.15x

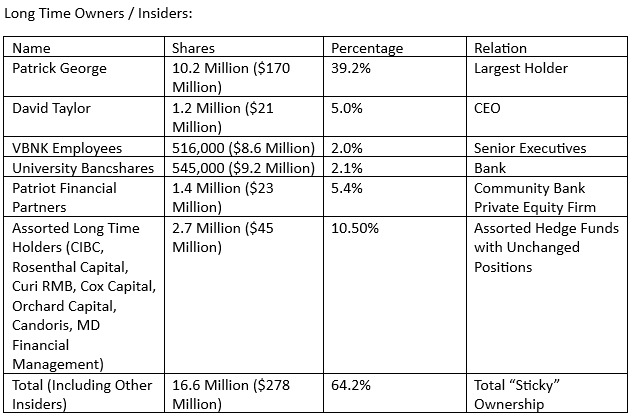

Insider Ownership: 46.19%

Market Cap: $435 Million

5 Year Net Income CAGR: 19%

5 Year Net Interest Income CAGR: 15%

Please note that the Per Share and Overall Figures in this article are denominated in Canadian Dollars, unless specifically noted as USD. Versabank trades on the TSX and the Nasdaq as VBNK. Net Interest Margin refers to the spread a bank generates between the yield it receives on its loans / securities, less the yield it pays on its deposits. In general, higher is better as long as credit quality is not compromised.

Quick Pitch:

As America is rapidly transformed into a nation where everything is financed and most people own nothing, Point-Of-Sale financiers face a conundrum: Where will they get the cash to finance it all?

Versabank has the solution.

Versabank is a growth name trading at a deep value multiple (6.9x 2025 P/E, 1.15x Tangible Book). Over the past decade, its highly invested insiders (11,998,000 shares, 46.19% of the company) have rapidly transformed it from a struggling Canadian outfit into a highly efficient Digital Bank specializing in innovative Point-Of-Sale financing solutions.

Unlike most online banks, Versabank is truly antisocial, and has zero direct contact with retail customers.

83% of Deposits ($3.1 Billion) originate from Wealth Management Firms such as RBC and Scotia Capital parking client cash in Certificates of Deposit up to the $100,000 CDIC Insurance Limit, which provides Versabank a distinct operational advantage over competitors in that it doesn’t need to provide costly customer service, online banking, and transfers. 17% of Deposits ($618 Million) originate from “Insolvency Professionals” such as Deloitte and BDO, who are appointed by the Court System as “Trustees” to liquidate insolvent businesses into cash. Versabank is the “go-to” partner for Insolvency Professionals as it embeds proprietary in-house financial technology within the “Trustee Checking Accounts” themselves, making it extremely easy for Insolvency Professionals to keep track of liquidation proceedings. In exchange for the free technology and banking services, Versabank pays these Insolvency Professionals essentially 0% on these deposits.

Versabank’s unusual deposit base not only affords it high operating leverage since there are no variable costs, it also eliminates two pertinent risks, interest rate risk and liquidity risk. Because 83% of deposits are CDs with a fixed maturity and interest rate, Versabank does not need to worry about a deposit run because 98% of deposits are insured and clients are prohibited from drawing funds until maturity, nor does Versabank need to concern itself with interest rate fluctuations since interest costs are fixed. Furthermore, Versabank’s “Insolvency Professionals” deposit base provides a crucial hedge against any economic cycle. As the economy slows and banking growth stagnates, bankruptcies and liquidations rise and Versabank is rapidly flooded with low-cost deposits from Insolvency Partners that immediately boost profitability.

Over the past 12 months, Insolvency Deposits are up 23.6% to $618 Million. Thank you, Trudeau, thank you.

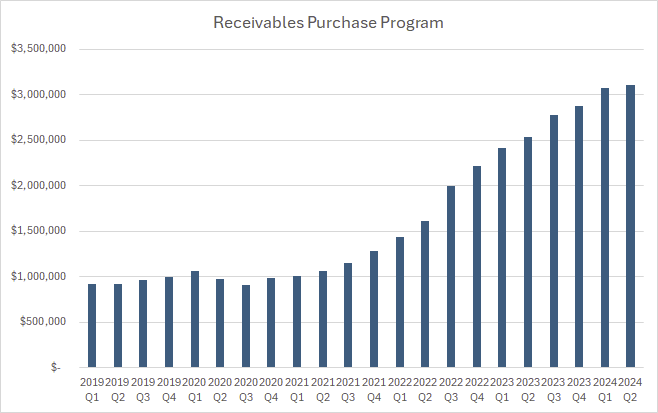

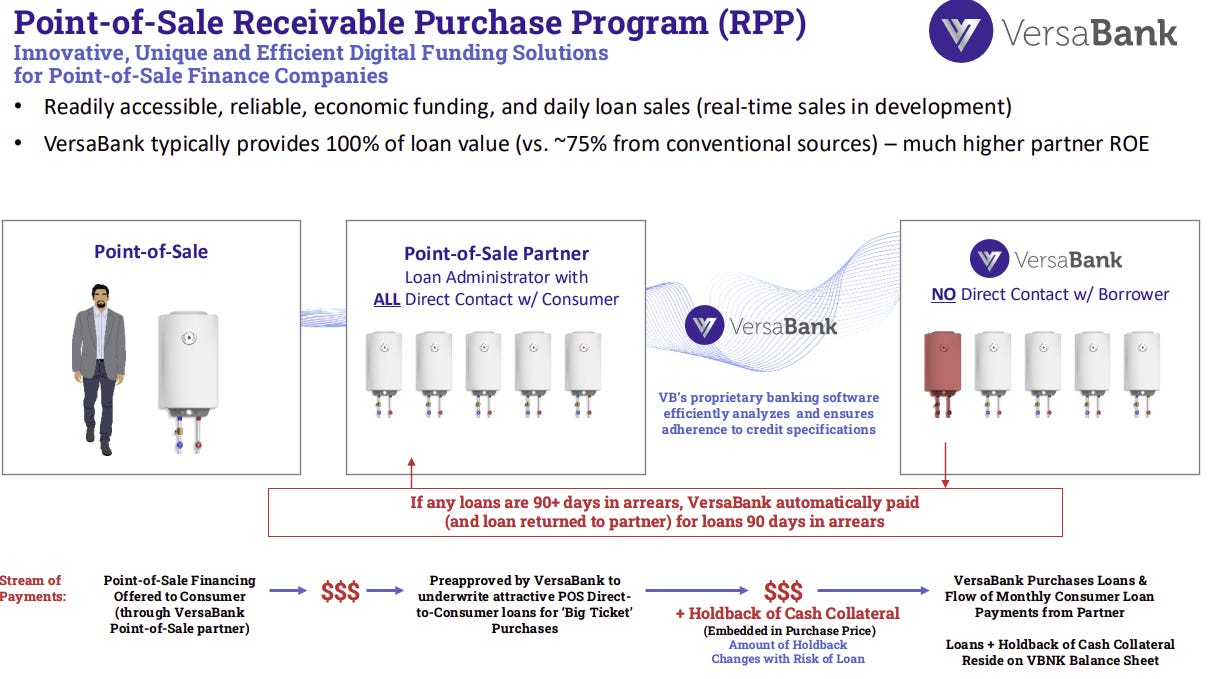

Where Versabank truly excels is its ground breaking Receivables Purchase Program, which provides Buy-Now-Pay-Later and Point-Of-Sale Financiers financing on high quality loans at attractive rates. Nearly every BNPL Firm lacks sufficient capital to hold the loans they originate on their balance sheet, as none of them hold a US or Canadian Banking License and thus cannot operate a bank. As a result, they need to draw on high cost revolving credit lines, sell high yield bonds, package loans into costly securitizations, or inefficiently sell loans on an individual basis. All of these options stink, and strip the lions share of the profits away. This is where Versabank comes in.

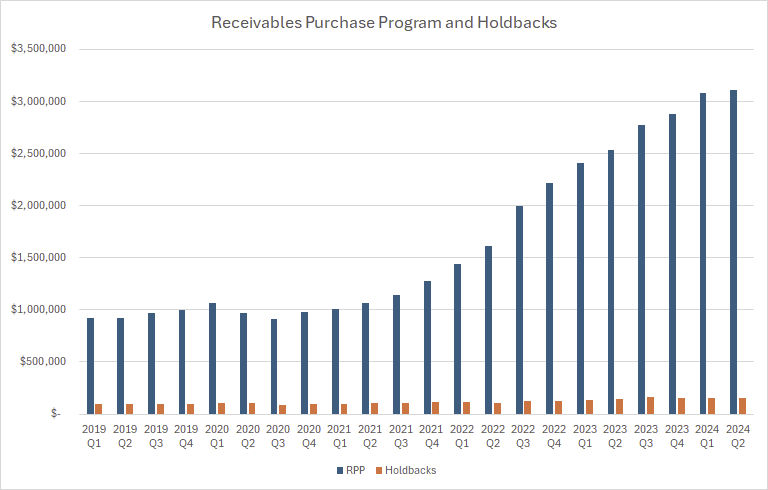

Versabank offers to “purchase” high quality receivables (loans) from accredited partners provided the loans meet strict criteria (High FICO, Maximum Loan Amount, Typical Duration 12 Months). There is obviously potential for a loan to go bad, so Versabank “holds back” a significant chunk of the purchase price, typically 3x the maximum estimated default rate (somewhere between 5-10% off the purchase price). Versabank is able to use this cash “hold back” to eliminate credit losses as Versabank is able to return any Non-Performing Loan (Loan Unpaid for > 90 Days) to the partner, and help itself to cold, hard cash from the “hold back” of the partner, neutralizing any credit loss.

Simply put, Versabank is funding 90-95% of a loan balance by “purchasing” a loan, but nearly all the credit risk lies with its partners as Versabank holds a significant cushion in the form of a “cash holdback”, if a loan has credit issues, Versabank simply returns the loan to its partner and collects cash from the “hold back” belonging to the partner.

This funding mechanism works for both parties, as Versabank is able to gather low cost deposits from Brokered CDs that are 100% insured, and offer leading and well capitalized Point-Of-Sale partners attractive funding at 2.00% - 2.50% above the risk-free rate (significantly lower than other options), while the Point-Of-Sale Partner still holds nearly all the credit risk.

You may be wondering why none of the larger banks have tried to replicate VBNK’s model. The better question is, why would they? Citibank and JP Morgan have Buy-Now-Pay-Later aspirations of their own, not to mention they make a fortune of fee-based income packaging loans as asset backed securities, syndicating revolving credit lines and term loans, and charging these firms to access the capital markets. Providing a solution similar to the Versabank Receivables Purchase Program would simply cannibalize their existing, highly profitable business. If you are charging someone to use a ladder, why roll out the red carpet and offer to build a staircase.

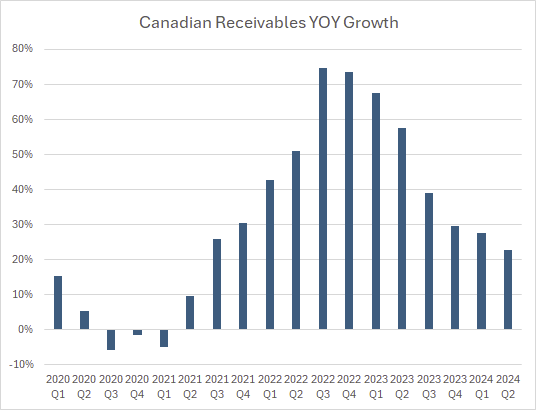

Versabank’s Point-Of-Sale Financing program is a superior and attractive offering to most BNPL firms, and the proof is in the pudding. Since the Receivables Purchase Program was launched in 2014, it has grown to nearly $4 Billion in active loans in Canada (with a typical loan duration of just 14 months), and the innovative “cash holdback” mechanism has enabled Versabank to avoid taking a single credit loss ever, even during the depth of the Wuhan Flu

What really gets me excited is Versabank graduating to the big leagues this Friday. After 24 months of waiting, Versabank’s acquisition of Stearns Bank Holdingsford (a minuscule Minnesota Bank with $10 Million in assets) has finally been approved by U.S. and Canadian Regulators, and is set to close later this week. Canada is the Little League of Point-Of-Sale financing, the giants of the industry, Affirm, Upstart, Afterpay, Bread, Klarna, are all American and the U.S. Point-Of-Sale market is dozens of times larger than Canada’s.

It’s not the branch itself matters, it’s the U.S. Banking License that comes with it. Like the first McDonald’s in Russia, K.F.C in Western Taiwan, or Cristopher Colombus sneezing on an unsuspecting victim, Versabank’s new U.S. Outpost marks a historic expansion; it will be able to immediately roll out the Receivables Purchase Program within the United States.

Unlike most banking expansions which are plagued by stock based compensation, entirely uninvested executives, and a bunch sweet nothings, Versabank already has the operating leverage and partners in place to hit the ground running. The exact same Wealth Management partners that so happily purchase Canadian denominated CDs up to $100,000 in Canada, will be immediately able to plow cash into U.S. CDs up to a $250,000 FDIC Limit.

Not only are Point-Of-Sale and Wealth Management partners lined up, the economics of the U.S. Operation are significantly better than that of Canada. In general, U.S. CDs are sold for 0.15% below the risk free rate (vs 0.15% above the risk free rate in Canada - thank you financially illiterate American HOAs and CD Ladders), and the U.S. Prime Rate is 3% above the risk free rate, whereas the Canadian Prime Rate is just 2.25% above the risk free rate. Since Versabank will be able to borrow cheaper and lend higher, capital deployed within the U.S. may earn a Net-Interest margin upwards of 3.50%, significantly higher than the 2.50% Versabank has achieved in Canada, and will generate significant Net Interest Margin expansion (Versabank’s Net Interest Margin has compressed from 2.96% to 2.45%, as short-term funding costs at 3 and 6 month tenors have risen faster than the prime 1 Year benchmark, since the yield curve is currently inverted).

Further upside for Versabank exists through a potential sale of it’s in house technology team, DRT Cyber. DRT Cyber has not only developed the embedded financial technology within the “Insolvency” Account Offerings, it also conducts firewall / network security services and penetration testing for more than 400 North American clients, mainly Police, Energy, and Utility companies. The cyber division is profitable standalone, and with annual revenue of $10 Million CAD, it may fetch as much as $60 Million in the event of a sale (this is a guess, obviously). As a condition of U.S. Regulatory approval, Versabank has pledged to divest this division within 2 years, and given it is on the books for almost nothing, a sale may generate $1 - $2 per share one time gain.

Even excluding the imminent roll out within the United States and the upside provided by a potential sale of the cybersecurity division, Versabank is undervalued on the Canadian operations stand alone value, and currently trades at just 9.0x Earnings and 1.15x Tangible Book (not to mention the potential hidden book value within the cybersecurity segment). Versabank has diligently and consistently grown earnings from $0.52 in 2017 to $1.58 in 2023 and $1.78 in the past four quarters, but trades at a depressed multiple for these six reasons:

Thin Float / Limited Liquidity: 46.19% of shares are controlled by company insiders, and a further 15.90% are controlled by Hedge Funds who have not touched their position since 2022. As a result, attempting to purchase a large stake in Versabank (Average Daily Volume of $225,000 CAD) would be like wearing a Winnie the Pooh Costume in Xinjiang, it takes balls and everyone notices immediately

Alienation - The company raised $63 Million USD (6.3 Million shares) in an offering in 2021 at an expensive multiple in anticipation of rapid expansion into the United States, along with an imminent launch of a Canadian Dollar stablecoin. The stablecoin plans fell through in 2022, and the regulatory approval process of the Stearns acquisition took way longer than expected. Despite Versabank aggressively repurchasing 1.5 Million shares in 2023, many bank investors lost considerable amounts and refuse to touch VBNK again

Confusion about Credit Risk - Since Versabank uses significant cash holdbacks to minimize credit risk, it doesn’t provision for credit losses on the Point-Of-Sale portfolio. As a result, at first glance it appears Versabank has zero credit protection, and as a result many investors may initially surmise Versabank has no clue what it is doing and bound to explode (it still could explode, but if VBNK goes, it’s likely SYF, CACC, BFH, AFRM, and UPST investors also join the club)

Grift is Good - One of the primary concerns from the few analysts who cover Versabank is despite booming earnings, the Net Interest Margin continues to compress. This is partially due to yield curve inversion, but mostly due to the fact Versabank is trading Net Interest Margin for Return on Equity, shifting it’s smaller allocation to real estate lending away from mortgages, and increasing its exposure to government backed initiatives, such as Public Sector Financing (up 30% Year over Year) and CMHC loans, which carry a government guarantee. Canada Mortgage Housing Corporation backed loans yield 0.50% lower than traditional products, but due to the government guarantee, carry a risk weight of zero. As a result, Versabank is simply griftingg off the government, doubling down on government backed business which generates smaller returns, but enables added leverage since there is no risk. Don’t hate the player, hate the game, if someone’s going to be grifting off government idiocy, it might as well be the company you own.

A lot of people seem to think VBNK is competing with Point-Of-Sale Financiers. Versabank isn’t competing with them, it is partnering with them. Versabank is simply financing the Point-Of-Sale Financiers themselves, and is in fact a tremendous ally. Versabank’s operating leverage and immediate access to deposits at the risk-free rate enables it to provides extremely advantageous financing terms to these Point-Of-Sale Companies, providing a brand new funding option as opposed to costlier financing like bonds, securitizations, and term loans.

Ironically, one of the only U.S. Analysts covering Versabank from KBW has just suspended coverage on all Canadian names. Almost no one within the United States is aware VBNK exists.

These unfounded assumptions and the overall thin liquidity have led to a depressed valuation. Insider ownership of 11,992,888 shares ($201 Million, 46% of the company) shouldn’t be thought of as a roadblock, but rather an asset. As I will discuss in greater detail in Ownership Structure, VBNK Insiders have purchased 1,603,534 Shares on the open market since 2018 for a total of $7,991,340 CAD, and sold a mere 1,228 shares over that same time period. Talk about commitment..

With industry leading operating leverage, an imminent launch of the U.S. Receivables Purchase Program, a potential sale of the Cybersecurity Division, and a dedicated management team that prioritizes risk management and has its balls on the table to the tune of $200 Million, VBNK is simply too cheap at 6.9x Forward P/E and 15% over book to ignore. VBNK offers an attractive opportunity to gain exposure to the Buy-Now-Pay-Later industry at a rock bottom valuation.

Table of Contents

Company History, Structure

Ownership Structure

Receivables Purchase Program Mechanics

Financial Analysis – “Pedal to the Medal”

Net Interest Income

Capitalization

Mental Gymnastics

Industry Relative Comparison / Absolute Analysis

Risks - Earnings Next Week

Why (I believe) VBNK 0.00%↑ Isn’t a Value Trap

Position and Conclusion

1. Company History, Structure

Versabank is a comeback story.

Versabank traces its roots to Pacific and Western Credit Corporation, which was taken over in 1993 by the current Versabank CEO, David Taylor, with the backing of the George Family (The George family has strong ties to the construction industry and stonemasonery, Patrick George has remained Versabank’s largest shareholder since the early 2000s).

In 2002, Pacific and Western (PWC) converted it’s Trusts business into a Schedule I Canadian bank, and grew to six branches. The 2009 financial crisis hit PWC hard, and by 2014 PWC was a penny stock, a steep fall from grace and the $12 level achieved in 2006.

PWC quickly realized it wasn’t able to compete at scale with larger financial institutions, and began winding down its physical branches and adopted the brokered CD (Wealth Management) deposit model. After conducting additional capital raises in 2012 and 2014, PWC launched what would ultimately become the “Receivables Purchase Program” to little fanfare. The Receivables Purchase Program quickly picked up steam, the automated nature of the program (Versabank specifies loan criteria, credit quality, maximum loan size, etc, and Point-Of-Sale partners underwrite the loans and transmit the details to Versabank electronically for funding) enabled it to grow quickly with minimal variable expense, and PWC quickly realized it offered superior returns to Commercial Lending / Credit Cards.

By 2016, PWC was winding down its unprofitable lending verticals (Credit Cards, Residential Mortgages, Commercial Loans), and shifting its focus entirely onto the Receivables Purchase Program. In 2017, PWC merged with its holding company (controlled by Patrick George), and rebranded as “Versabank”.

By 2021, the Receivables Purchase Program had grown immensely (from $779 Million in early 2017 to $1.279 Billion), and Versabank wisely tapped the capital markets to raise $63 Million in Common Equity, $14 Million in Preferred Stock, and $75 Million in subordinated notes (at 5.00%). At the time, Versabank was nearly 40% above tangible book and 14x forward earnings, the capital raise was certainly well timed and a great deal.

Versabank also took the very corny step of attempting to enter the crypto space (yuck) in 2021, announcing the imminent launch of “VCAD”, a Canadian denominated and regulated stablecoin. Doesn’t get more Cathie Woods and 2021 than this, does it?

As 2022 rolled in, low-interest rate market euphoria quickly turned into margin calls, and Versabank was halved from $16 in 2021 to just $9 in late 2022 as the crypto plans were abandoned.

In August 2022, Versabank announced the Stearns acquisition (to expand into the United States) and an aggressive repurchase strategy, since it was trading just under 9x earnings and 25% below book. Over the next 12 months Versabank repurchased 1.5 Million shares around $10 CAD a share, but remained between the $10 and $11 level until a blowout earnings report in December 2023, where EPS of $0.47 ran circles around the $0.41 estimate, and the Receivables Purchase Program surprised with additional 30% Year over Year growth.

Ironically, the company announced a substantial issuer bid to repurchase 2 Million shares, but promptly withred it as Versa skyrocketed from the mid 10s to $16.

I don’t blame Versabank for cancelling the buyback. It’s one thing to repurchase stock at 5 or 6x earnings, but when you are suddenly at 9x and have a major expansion about to take place, can you really be blamed for playing it safe?

I began purchasing Versabank in February and March, and have added significantly around the $14 Level ($10 USD) especially after the American / Canadian regulatory institutions approved the acquisition of Stearns in June.

What’s really interesting about the price action this year is Versabank suffered some unexpected, high volume drops from February to May of this year. After doing some digging, I discovered that a tiny OTC bank, University Bancorp $UNIB, was a holder of 4.6% of VBNK, and offloaded approximately 650,000 shares to bring its position down to 2.1%. It’s interesting as VBNK’s YTD volume is just 6.7 Million, and just 2.3 Million shares traded from April to June, meaning that UNIB’s 650,000 sale represented a massive 28% of volume during that period, and likely suppressed the price.

Fast forward to today, and Versabank is trading within 1% of it’s November 2021 peak. Earnings have grown more than 100% since then, Versabank currently sits at 9.0x Trailing and 6.9x 2025 Earnings, and a minimal premium over book, which is especially interesting as it is clear there is some degree of intangible value generated by the profitable Cyber Security division.

Recent increased volume is likely attributable to Versabank’s investor relations push. Alongside a refreshed website, the Versabank IR team has travelled to the KBW Banking Conference, the ROTH Banking Conference, and the OTC Banking Investors Conference to promote Versabank’s pending U.S. Rollout.

With day one partners lined up for the imminent rollout of the U.S. Receivables Program, I think Versabank’s U.S. Potential is finally catching investor attention.

2. Ownership Structure - And Commentary

Patrick George and David Taylor own a significant portion of the company, roughly 44%. Both have purchased more than 200,000 shares each on the open market over the past 5 years.

Aside from the VBNK Insiders and Employees who control nearly half the company, Patriot Financial Partners (a community bank specialist) owns just over 5%, and an assortment of Financials oriented funds, who have minimally changed their position over the past 2 years, own a further 10%. (run on sentence?)

As a result, of the 25.9 Million shares currently in circulation, roughly 16.6 Million (64.2%) are owned by insiders and long time investors, leaving just 9.3 Million shares to actively change hands.

On a side note, I think it is highly interesting that there have been no insider purchases since June 14th, right before Versabank received final approval to close its U.S. Acquisition. Insider purchases have occured at a very regular cadence since Versabank’s fresh listing in 2017. Could the pause in purchases be due to an important pending announcement. Partner blowing up? Cybersecurity division developments. There is no way to tell for certain, but given the chipper tune being sung at the investor relations presentations, I would be surprised if there was a material negative announcement in the works.

Nevertheless, I find the significant insider purchases encouraging. There is rarely a better incentive to avoid doing dumb things than knowing you have a significant portion of your net worth tied up in your company. Of course, there are outliers (looking at you Riley and Altice), but in general I think banks with committed, invested insiders outperform and demand a higher multiple.

3. Receivables Purchase Program Mechanics

The Receivables Purchase Program entails Versabank signing Master Purchase Agreements with Point-Of-Sale Partners. Within these Master Purchase Agreements, Versabank pre-approves their partners to underwrite small-ticket loans with stringent terms on credit quality and the length of the loan. The beauty of this is Versabank has no direct interaction with the customer, and the cost of underwriting falls upon the partner. Once the loan is processed, it is electronically sold to Versabank.

Based on historical default rates and the balance of a partner’s “hold back” account at Versabank, Versabank purchases the loan at par, but retains anywhere from 4-15% of the loan value as a “holdback” to remain at Versabank to cushion any credit issues. For example, if a partner originates $100,000 in loans and Versabank estimates maximum historical defaults at 2%, Versabank will retain 6% ($6,000) as a cash holdback, and electronically transmit $94,000 to the partner. The $6,000 cash holdback belongs to the partner, but accrues essentially no interest (to the benefit of Versabank), and if any loan become Non-Performing (no payments for 90+ days), Versabank can immediately sell the loan back to the partner at par and collect the cash value from the holdback account.

This “holdback” approach works remarkably well for Versabank and its partners. Even during the height of COVID, holdbacks proved sufficient are Versabank did not sustain a single credit loss.

Furthermore, Versabank has the ability to dynamically modify the hold-back rate to ensure the credit cushion remains sufficient. Since the loans reside on Versabank’s books, Versabank can easily detect when credit issues arise. If a partners loans are performing significantly worse than they did historically, and Versabank becomes concerned that the 3x maximum default holdback is insufficient, they can increase the holdback rate to replenish the holdback account. If the partner is unwilling to agree to a higher holdback rate, they are immediately cut off from further business.

Versabank has more than 100 Canadian partners (such as FinanceIt), providing significant diversification. The loan book is primarily comprised of HVAC System Loans, with a smaller portion allocated towards Home Improvement, Barbeques, and Auto. The opportunities within the United States, however, are endless.

The maximum term of any loan is 60 months, but the vast majority of the Receivables Purchase Program loans are structured with shorter terms, and the duration of the average loan is just over 14 months. This reduces credit risk, as shorter duration loans make it significantly easier to spot when credit is underperforming and a partner may be in trouble.

Versabank doesn’t just have an extremely cautious approach to credit (by maintaining cash holdbacks at 3x maximum historical default rates), it also has an extremely hands on approach to partners, conducting annual in-person audits to check on a partners financials and overall profitability. If Versabank detects a sharp decrease in a partner’s operations, it cuts the partner off from the network. Versabank also maintains backup servicers on all loans, meaning that if a partner ever goes into bankruptcy, Versabank still receives the underlying payments and has the cash holdback to fall back on if any trouble arises.

This mechanism has resulted in no credit losses since inception, and given the significantly larger partners available in the United States, I think Versabank will be able to maintain credit quality, and achieve significant growth simply by providing the Receivables Purchase Program to larger, safer, American partners, who are hungry for funding.

The Point-Of-Sale financiers could indeed attempt to start their own banks to preclude the need for Versabanks program, or traditional financing options. This is extremely unlikely, however, as getting regulatory approval for a banking license takes years, not to mention it is extremely difficult to operate a brand new bank profitably. Affirm, who is starved for funds, does not have a banking license but outsources “Affirm Bank” to Cross Rivers Bancshares, who does have a banking license. Goldman Sachs attempted “Marcus High Yield Savings” accounts, but it failed miserably. Perhaps the only Point-Of-Sale financier with a somewhat successful banking operation is Bread Financial, and that is because they are happy to pay 5.5% since it is still cheaper than borrowing at 11%. Simply put, no bank, or Point-Of-Sale financier for that matter, has figured out the Brokered CD Versabank uses to generate such significant earnings and operating leverage.

Versabank’s Receivables Purchase Program offers a superior solution for well-run Point-Of-Sale financiers, as they are able to secure financing at attractive rates (2.00 - 2.50% above the risk free rate in Canada, 3.00 - 3.50% in the United States) relative to other expensive options, such as term loans, unsecured bonds, or asset backed securities, without needing to operate a bank or have a banking license. Versabank will be able to generate significantly higher returns on capital within the United States, as borrowing costs are lower, and the prime rate is generally half a percent higher relative to the risk free rate than it is in Canada. The Receivables Purchase Program has an excellent history of risk management, and with the U.S. Point-Of-Sale market approximately 1000% larger than Canada’s, I think the sky will be the limit for Versabank within the United States.

4. Financial Analysis – “Pedal to the Medal”

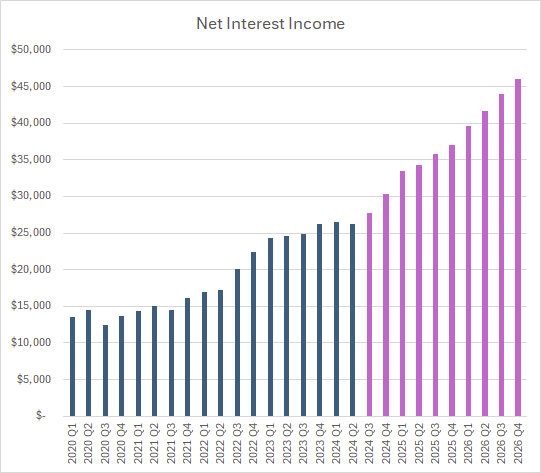

1. Net Interest Income

Over the past 5 years, Net Interest Income Growth has averaged 15% a year. Growth in the most recent year has been tapered as Versabank has largely tapped out the entire Canadian Point-Of-Sale market, but assuming the U.S. Receivables Program grows at $150 Million a quarter starting in Q4 (pretty reasonable given the Canadian program still grows at $200 Million a quarter, and Canada is obviously a smaller country) Versabank could conservatively achieve 21-25% Annual Net Interest Income growth. Given Versabank's high operating leverage and minimal footprint, the annual increases will translate almost dollar for dollar into pre-tax profit.

As the growth within the Canadian Receivables Program has leveled out around 20%, I think it is an extremely reasonable assumption to guess that the overall program maintains 20% annual growth now that the U.S. Segment will soon be operational in September.

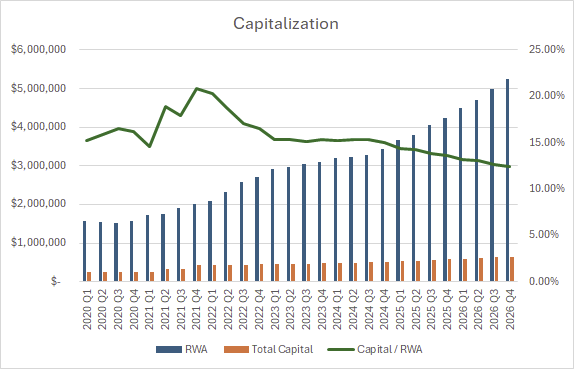

2. “Build It and They Will Come”. Capitalization

The main issue for Versabank isn’t how much of the U.S. Market they can get, it’s how much of the U.S. Market they can take.

Assuming a conservative 20% total growth rate in the Point-Of-Sale Receivables Portfolio, Versabank’s Total Capital relative to Risk-Weighted Assets will decline from 15.33% currently, to 12.39% at the end of 2026.

The U.S. has an effective minimum Total Capital ratio of 10%, meaning that if Versabank continues to grow the loan portfolio 20% a year, by 2028 or 2029 they will run out of capital.

The main risk to Versabank in my opinion, is not credit risk, nor is it earnings. I think the U.S. Rollout may entail some front-loaded expenses, but ultimately I have no doubt the program will be massively successful. The main risk is Versabank jumps the gun, and pulls a secondary offering at the current valuation to raise capital for the U.S. rollout, since they know demand is likely massive. I doubt they would do this, as they have been banging the table on how they are undervalued, and given the insiders own approximately half the company, pulling a secondary offering at the current valuation would be kneecapping themselves. Nonetheless, Versabank is smelling huge opportunity within the United States, and one of the reasons they cancelled the 2024 share buyback was to preserve capital for a smooth U.S. rollout.

There are numerous alternatives to raising additional capital without issuing common equity:

Issuing additional subordinated notes

Issuing preferred equity

Shifting a larger portion of the legacy balance sheet (mortgages) into zero risk-weighted assets, such as government backed mortgages (albeit at lower interest rates)

Overall Versabank has demonstrated proficiency with the capital markets. They raised capital at the 2021 highs, and repurchased 25% of these shares at the 2023 lows. While a secondary offering is a risk, tthey seem to be aware they are undervalued especially given a potential sale of the Cybersecurity division, so I am not too concerned about a secondary offering unless $20 a share is breached.

3. Mental Gymnastics

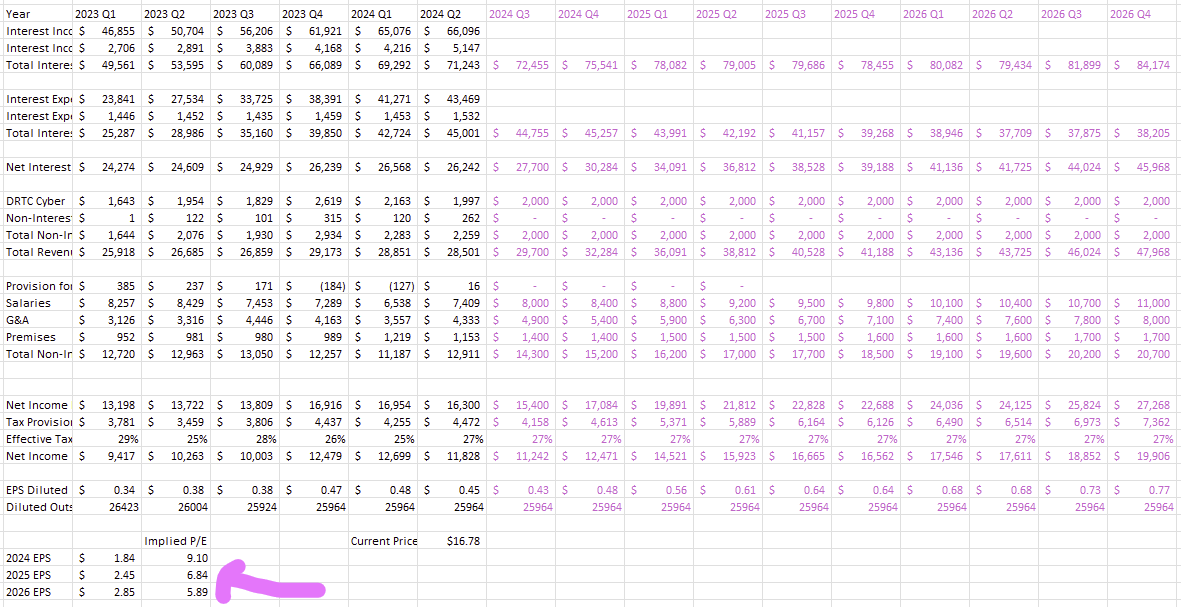

This section is entitled “Mental Gymnastics” because that is what modelling is. If I modelled VBNK and got an EPS I didn’t want, I would remodel it until I did. Ironically, I actually wound up with a 2025 EPS that seemed too good to be true, and so I had to walk it down and add copious “expenses” to make it seem reasonable. Nonetheless, assuming the U.S. Receivables Program operates at a slightly better Net Interest Margin than the Canadian Program, that total loan growth averages 20%, and all else remains largely the same, Versabank is roughly 6.9x 2025 EPS.

I think my model lies (ha) on the conservative side, as Versabank has a stated goal of hitting $5 Billion in assets this year, and my low-ball assumptions have them hitting $5 Billion in the middle of next year. Ironically, my 2025 estimate comes out exactly at the consensus estimate, but I also realized I forgot to add preferred dividend payments which chip away 2 cents a year. Wonder if anyone has the attention span to make it this far in the article. My model is just make believe, and I’d bet the consensus is too. I have a better chance of guessing what direction an NYC rat will come from than how quickly Versabank will grow within the United States.

Bottom line is VBNK 0.00%↑ at the current P/E of 9 is already attractive, but if Versabank achieves even lethargic growth within the United States, it is on track for $2.45 in 2025 and $2.85 in 2026, which would imply a P/E under 6 by then, at the current levels.

In case it wasn’t obvious, the wishful thinking numbers are highlighted in “Hot Pink”, in solidarity with Sydney Sweeney.

Overall, it seems clear Versabank is already a value name, but with a conservative rollout of its Receivables Purchase Program within the United States primed to begin just next month, Versabank is truly a growth name walking around at a deep value multiple.

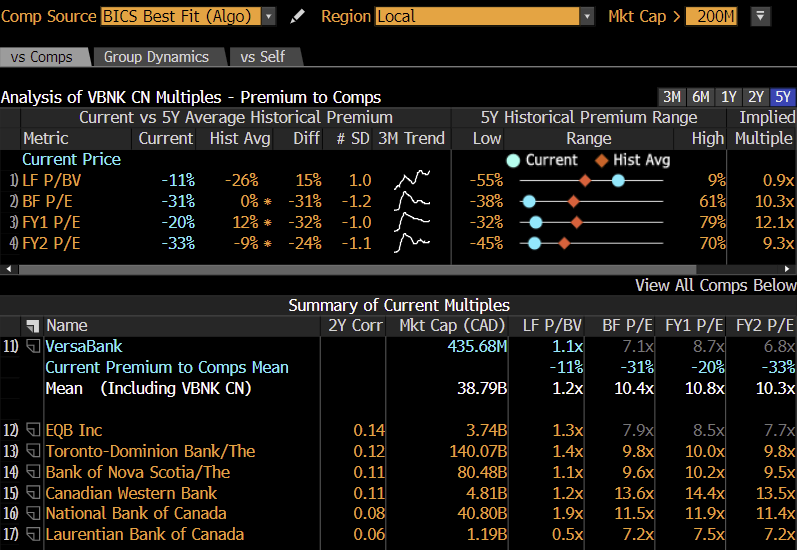

5. Industry Relative Comparison / Absolute Analysis

It’s truly impossible to find a close comparison for Versabank due to the short nature of Versabanks loans (14 months) and its unusual deposit base.

Among Canadian banks, it is certainly cheaper than peers, although this comparison isn’t quite pertinent as within a few years Versa may actually do the majority of its business within the United States.

Laurentian Bank looks similarly inexpensive, however that is because they are deeply underwater on Billions in low interest rate mortgages. TD has a money laundering issue, Canadian Western is getting purchase by National Bank of Canada, and BNS is a loner. Interesting RBC isn’t on the comps list, it’s essentially the Canadian giant.

What’s really interesting is there is essentially just one listed name within the United States that has a somewhat similar deposit model to Versabank. Medallion Financial MFIN 0.00%↑

Medallion Financial relies entirely upon brokered CDs, but unlike Versabank they engage in high risk lending practices, and also have an active SEC Investigation into promoting their own stock. Not to go off on a rant here, but I actually don’t mind that.

Time after time I used to tell myself the people who cut the line at traffic exits / grifters ultimately pay the price, but do they? In general, people tend to get away with things, Karma isn’t really real, and those who take advantage of others have no real sense of shame. It’s just something we tell ourselves to rationalize the situation (you can tell it’s getting late here).

Back to Medallion, and tangentially Versabank, grift is good. If Medallion thinks its stock is undervalued and they try to promote it, or if Versabank realizes the Canadian government is giving away free money through subsidized mortgages, or some tiny regional slams the Bank Term Funding Program to squeak out an extra 0.25% on their securities portfolio, good for them. The money is going to be made by someone, it might as well be made by the company you own.

Back to the valuation, VBNK 0.00%↑ is clearly undervalued relative to the regional banking index as a whole (12x Forward P/E), and also severely undervalued relative to its historical multiple and on an absolute basis. This is likely due to many factors, and perhaps most prominently, the market not understanding Versabank’s Receivables Purchase Program, and not realizing the immense opportunity Versabank has to grow within the United States.

6. Risks - Earnings Next Week

The most fatal risk to Versabank is clearly a sudden economic downtown, that causes one of their partners’s loans to deteriorate so rapidly the “cash holdback” which is 3x the maximum projected default rate is insufficient to cover all losses. On the flip side, Versabank made it through the 2016 slowdown and the 2020 Covid meltdown unscathed, so I think this is a relatively unlikely risk, and if you are indeed concerned about something like this, it’s highly likely the rest of the consumer credit financials sector also get destroyed (looking at you World Acceptance, Credit Acceptance, and most importantly Bread Holdings).

I think the most likely risk is actually too much success. Versabank will likely be able to generate a substantial ROE on it’s brand new U.S. Segment, and I am worried they will try to raise capital at deeply undervalued levels. Nonetheless, the heavy level of insider ownership, and their previous track record of top and bottom ticking the market through a secondary and subsequent buyback leads me to believe they understand they are undervalued, and would only even begin to consider a secondary offering if Versabank hit a premium valuation at least 15-20% higher.

There is a possibility Versabank makes a big splash and some enterprising regional bank attempts to copy their purchase program, but I think that’s unlikely. It takes time and experience to establish partners, and more importantly takes data and experience to accurately forecast maximum default rates. I think there is a high probability a credit union or regional bank teams up with Versabank to provide capital, and Versabank ends up getting risk-free fee based income by running the Receivables Purchase Program for someone else. This was actually mentioned during the most recent investor roadshow, so it is a possibility if Versabank simply grows too quickly, and wants to shift towards fee-based income by partnering up.

The last risk is I am posting Versabank two weeks before earnings, which in general is indicative of horrible timing.

On a side note, I think it is unusual they are reporting earnings in September. Every year they report Q3 earnings in August. I think the reasoning behind the September 5th choice is that they possibly want to announce how many loans they have already processed in the first few days of September, given the fact they already have partners lined up to get started on day one.

On the flip side, I have Versabank reporting earnings in the range of 43 - 45 cents next week, a deceleration from Q2. I don’t think this is a bad thing. As previously discussed , capital deployed within the U.S. Receivables Purchase Program should be significantly more accretive to earnings than when deployed in the Canadian Receiveables Purchase Program, due to a easy CD conditions within the United States, and an overall larger spread between the risk free rate and the Prime Rate.

We know growth will be immense and Versabank may one day be capital constrained, so why not intentionally slow down growth in Canada and repurpose excess capital to the United States. Versabank had a stated goal of hitting $5 Billion in assets this year. I think the U.S. Economy is significantly stronger than the Canadian economy, and thus a stagnation of loan growth in Canada in next week’s earnings report should not be too much of a concern if they push the $5 Billion target back, the future for Versabank is America.

Interestingly, if Versabank is able to conduct more business within the United States than Canada within a few years, it will be eligible to shift its primary listing to the U.S. making it eligible for Russell inclusion resulting in significant passive buying.

7. Why (I believe) VBNK 0.00%↑ Isn’t a Value Trap

I think VBNK’s significant insider alignment, low valuation, and conservative management style with a proven track record of risk management make it attractive. I think the excellent capital returns conducted in 2023 demonstrate the management has an astute understanding of capital markets, and I think the imminent start of the U.S. Point-Of-Sale Financing Segment, which the market has been waiting on for nearly 24 months, is about to transform Versabank from a “let’s see story” to a “we should’ve seen” story.

The perfect storm is brewing for Versabank, it is working on a sale of the cybersecurity segment, imminent entry into the United States where the economics of the purchase program and breadth of partners makes Canada look like little league, and the prospect of rate cuts provides immediate Net Interest Margin relief (as Versabank borrows at 3 and 6 months tenors, and lends based off the 1 Year rate).

Versabank has a time tested, superior business model that affords it incredible operating leverage, yet despite the largest growth opportunity since its founding set to begin next week, it is priced like a deep-value name in terminal decline. With overall ownership of more than $200 Million, the insiders understand that consistent growth and expense control is what will make them, and the company, the most money and this is exemplified by the fact that most Versabank employees have significant ownership in the company and have purchased more than 1.6 Million shares on the open market since 2018.

What’s a fair value for $VBNK? I’m not really sure. Will 2025 EPS be $2.45 CAD ($1.78 USD)? I am also not sure.

But if Versabank continues growing as it has done over the last 5 years, with its innovative operating model, conservative and aligned insiders, and history of risk management, is it worth just 6.9x 2025 earnings and 15% over book? I think not.

I think Versabank at $16 ($12 USD) represents an attractive opportunity to gain exposure to the rapidly growing Point-Of-Sale Financing industry with less risk at a rock-bottom valuation.

In a world where everything from braces to ACs to Dominoe’s Pizzas delivered on Uber Eats are financed in “4 easy payments”, why not cut yourself a small slice of the pie?

8. Position and Conclusion

Long 79,800 shares at $14.75 CAD ($11.96 USD)

Once again, not advice.