It's Just More Fun the Second Time Around - $CBL, You Decide

When Life Hands you Lemons, Declare Chapter 11 and Try Again

Disclaimer: Before we get to the fun stuff. This post is not financial advice, and not a solicitation to purchase or sell securities. You should conduct extensive research before engaging in any type of investment decision, and consult a financial advisor / tax advisor. As a reminder, this article is written by a guy impersonting a decades old movie character online, it should not be taken seriously. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the post before making any decisions based on such information. By reading this post, you acknowledge that the opinions expressed herein may be highly inaccurate and unfounded, that this article is for informational, educational purposes only, and to indemnify and hold harmless the author (me) from any claims / actions arising from your reading / sharing of this article.

The original post was made on November 18, 2024. For some reason it doesn’t show it the app, so I am trying to republish it to see if I can make it appear.

The content herein is the exclusive content of Chief’s Substack, All Rights Reserved.

The article is an expanded thesis of the original tweet

Quick Stats:

Name: CBL Properties ($CBL)

Sector: Real Estate

Price: $27.29

2024 P/FFO: 4.1x

2024 Free Cash Flow Yield: 17%

Market Cap: $839 Million

Insider Ownership: 64.5%

2-Year Dividend Growth: 60%

2-Year FFO Growth: -17%

Note: This article will discuss REIT specific terminology such as Funds From Operation and Net Operating Income. You should familiarize yourself with how these metrics are calculated, as P/E is not an applicable metric for Real Estate Investment Trusts.

Quick Pitch:

If at first you don’t succeed, declare Chapter 11 and try, try again.

CBL Properties is an internally managed REIT specializing in mid-tier Malls and Open Air Centers, trading at a deep discount to its own net asset value, and a tremendous discount to closely comparable peers. CBL is a comeback story, it emerged from Chapter 11 Bankruptcy Protection in August 2021 with a “refreshed” balance sheet (flushed $1.7 Billion in creditor claims away) and a mission to further deleverage the company.

Since its return to the public markets, CBL has made tremendous progress. It has reduced debt from 6.4x Net Operating Income to just shy of 5x (really closer to 4x if you strip out non-recourse properties that don’t generate cash flow), consistently returned unprofitable properties to lenders, improved occupancy levels, refinanced its high yield debt, and most recently, shifted its focus from deleveraging the balance sheet to returning cash to the shareholders.

CBL management is aware the company trades at a deep discount, and is taking expeditious action to address it. Over the last year, CBL 0.00%↑ has repurchased 1.57 Million shares (8%) of the float; 1,074,826 shares at $23.26 through its $25 Million regular repurchase authorization, and 500,000 shares at $25.05 in a special block transaction at the end of October. CBL has also consistently raised the dividend as it deleveraged the balance sheet, from $1.00 in 2022 (annualized), to $1.50 in 2023, to $1.60 in 2024.

Despite an improving balance sheet, strengthening fundamentals, and a recent pivot towards returning cash to shareholders, CBL trades at just a third of the valuation peers do at 4.1x Funds From Operation (FFO), as compared to Macerich (12x), Kimco (15x), Tanger (17x), and Simon Property Group (14x). In fact, since the October 2022, peers have risen more than 100% on average as sentiment towards retail Real Estate skyrocketed, while CBL’s stock price has remained un-changed.

While you can make a decent argument that Macerich and Kimco have higher quality properties, the valuation gap between CBL and peers is unseen throughout the entire REIT sector. In fact, CBL trades as such a low valuation, even Medical Properties Trust ($MPW), a deeply troubled REIT with Credit Default Swaps indicating extremely high credit risk, trades at a higher P/FFO multiple than CBL. There are plenty of names that appear optically cheap on paper, but how many of them have heavily invested management teams repurchasing shares hand over fist with an improving cash flow profile?

The discount to peers is even more surprising given the best is yet to come: CBL benefits the most from the rates down environment. Nearly 39.1% of CBL’s borrowings are floating rate, significantly higher than Macerich (5%), Simon Property Group (1.5%), Kimco (1%), and Tanger (26%). While the use of floating rate debt hurt CBL in 2022 and 2023 as rates soared, it should now be thought of as an asset as the rate move rapidly reverses itself. The 75 basis points of cuts from the past two Fed meetings provide CBL with immediate relief; interest expense will decline $7.4 Million on its $971 Million in floating rate borrowings, affording it additional firepower to repurchase shares next year. If the market is indeed correct and we see a further 75 basis points of cuts by December 2025, CBL’s FFO should grow 6-7%, and “Discretionary Cash Flow” (Funds From Operation less debt paydown and capital expenditures) may balloon as much as 30% over the next 4 quarters, providing it added financial flexibility.

Not only is the falling rate environment benefiting CBL’s variable rate debt, CBL itself is opportunistically extending maturities on fixed rate borrowings and negotiating lower interest rates. In July, CBL refinanced a $16 Million hotel loan set to mature this November, lowering the interest rate 0.7% and pushing the maturity out to 2029. Last week, CBL was able to refinance its $45 Million Hammock Landing, FL loan, lowering the interest rate from 8.20% to 5.86%, and pushing the maturity 8 years from 2026 to 2034.

CBL has a very unusual structure. Unlike peers like Tanger and Simon Property Group, who conduct most of their borrowing at the parent level, CBL, similar to Vornado Realty Trust, conducts most of its borrowing the property level in the form of non-recourse loans. This provides CBL significant optionality, as unlike peers who frequently get stuck with losing properties, CBL is able to simply return losing properties to lenders, with no financial penalty to the overall company. CBL is able, and has frequently used the threat of returning properties to bully lenders into lowering interest rates, significantly extending maturities and in some cases reducing the outstanding balance of the loans. While this is a cutthroat tactic, I like that CBL has no issue railroading the lenders to save the shareholders from pouring money into poorly performing properties. The diagram below illustrates the use of this tactic.

Now, some common concerns everyone has seems to have when considering Retail REITS is 1) Debt is Un-Manageable and 2) Retail is Dead.

While both of these are easy to assume, the facts show this is not the case for CBL. CBL’s Debt to EBITDA (I hate this metric) is 5.4x, right in line with Kimco (5.6x), Macerich (8.6x), Tanger (4.9x), and Simon Property Group (6.3x). Furthermore, over the next 3 years 42% of CBL’s debt is set to mature, vs 41% for Macerich, 72% for Tanger, and 40% for Simon Property Group. It’s obvious that CBL’s debt profile / leverage profile is extremely similar to peers, and given the recent spate of refinancing CBL is having no issue rolling over debt. The second concern, that retail is dead, is also unfounded. CBL’s same store sales are finally increasing (after declines during 2021-2023), and heightened demand for space has resulted in rent increases of 9% this year, the first such increase since 2021. This is largely due to CBL’s portfolio reshuffle, since emerging from bankruptcy is has return struggling properties in the Mid-West and Atlantic regions, and focused its effort on locations in the growing Sunbelt region. Occupancy is increasing and is set for further improvements as Rue 21, a previous tenant, emerges from bankruptcy with plans to open 14 new stores by the first quarter of 2025.

Simply put, CBL has turned the page. Leverage has decreased significantly, operating metrics continue to improve, discretionary cash flow is set to jump almost 15% next year after the recent rate cuts, and management team is attentive to the discount the stock is trading at, and is actively repurchasing shares.

You might be saying if all of this is true, how can CBL trade at a third of the valuation comparable peers trade at?

The truth is I have no idea, but I do have a few guesses:

Low Liquidity - 65% of CBL is owned by distressed specialists such as Canyon Capital Advisors and Oaktree, as well as long-time company insiders. Given only $300 Million is floating and daily notional volume of just 500k is low, I think large institutions are dissuaded from establishing position.

Lack of Analyst Coverage - There is only one equity research analyst covering CBL, from Odeon Capital (a microcap specialist).

Anger - The few people who are aware CBL exists are likely angry. CBL’s epic implosion from 2014-2017 caused significant pain to main REIT / preferred investors, and they are simply unwilling to get involved in a name that caused them financial losses.

It is interesting to note that while the equity market has largely ignored CBL’s impressive comeback, the fixed income market has not.

CBL’s $735,500,000 Recourse Floating Rate Term Loan (SOFR + 275), maturing in November 2027 has roared from a low of 80 cents on the dollar in 2023 to 93 cents, and CBL’s $360,000,000 1L Loan, maturing in June 2027 has jumped from 93 cents earlier this year to 99 cents on the dollar, nearly par.

The current setup for CBL reminds me of what I saw in International General Insurance, Versabank, and to a lesser extent Talen Energy and Sila Property Trust. The company is trading at a tremendous discount to book value and peers and coverage is low, but the company has an invested management team and is taking expeditious action to address the discount and allocate capital where it is most efficiency, through sizeable share repurchases. With approximately 5% of outstanding shares (and 15% of the float) repurchased in the last 12 months, I think time is on CBL’s side and as cash rolls in, interest expense declines, opportunistic refinancing occurs, and further capital return initiatives are announced, the market will become attentive to deep discount CBL is trading at.

At an industry-low valuation and a tailwind from rising occupancy and falling interest rates, along with insiders and distressed specialists who have board representation and their balls on the line to the tune of $536 Million, I think CBL at a P/FFO of 4.1x and a Free Cash Flow yield of 17% is simply too cheap to ignore. CBL offers an attractive opportunity to gain exposure to renewed retail real-estate interest and falling interest rates at a rock bottom valuation.

Table of Contents

Company History

Ownership Structure

Property Overview, Geography

Financial Analysis

Impact of Lower Rates

Occupancy / Rent Levels

Returning “Cash Trapped” Properties

Adjusting out “Debt Discount” Accretion

Management Consistency and Guidance Accuracy

Capital Returns

Relative Valuation

Risks

Conclusion

1. Company History, Structure

CBL Properties was previously known as CBL and Associates. Although CBL and Associates made it through 2009 and nearly set a fresh all time high in 2014, it exacerbated its issues through aggressive expansion in malls centered around troubled “anchor tenants”. In 2017 as tenants like Sears and J.C. Penney began to implode, it became clear that CBL and Associates itself was a distressed name and by 2020, CBL was a penny stock with senior notes trading at just 50 cents on the dollar. The Wuhan Flu placed the finishing kiss on CBL and Associates’ whimpering end, and it filed for Chapter 11 Bankruptcy shortly after in November, 2020.

The bankruptcy was interesting in; common and preferred equity were not entirely wiped as everyone was agreeable and the process took place quickly. Common shareholders of CBL & Associates received 5.5% of the new CBL, and preferred equity holders received 5.5% of the new entity. Unsecured creditors received the vast majority of the new entity, 78.42%, as well as a portion of $455 Million in 10% Senior Notes, and first-lien holders received 10.58% of the new entity, a majority of a $884 Million floating-rate term loan, and $150 Million in 7% Senior Convertible Notes. Overall, $1.7 Billion in creditor claims was flushed down the drain, and CBL emerged from bankruptcy just 12 months later, in Novemeber 2021 with a significantly healthier balance sheet.

CBL immediately took steps to reduce leverage and improve cash flow. It exercised its option to convert the $150 Million in 7% Senior Convertible notes into 10.9 Million shares, and began taking out smaller loans on un-encumbered properties (properties that have no debt / liens) to start paying down its $455 Million in 10% Senior Notes. Most importantly, perhaps, it decided to start screwing lenders. CBL has a distinct operational advantage over other highly indebted REITs, it is internally managed and the vast majority of its debt is non-recourse. I won’t name names, but many externally managed REITs have a very perverse fee-structure where the manager is paid a portion of the face value of REITs assets. This leads to, in many instances, the external manager trying to rescue “cash trapped” properties (properties that do not produce any cash flow), as returning the properties to the lender would reduce overall assets and the fee income the manager receives.

Luckily, CBL does not have this problem, and given the vast majority of its debt is non-recourse, CBL can play the financial equivalent of “chicken” with lenders: it can demand debt extensions / reductions by using “foreclosure” as a threat. In Q3 of 2021, CBL started off with a bang, entering into “negotiations” on 4 properties with $213 Million in debt. By Q4, CBL was able to “negotiate” a $36 Million recourse loan on its Gettysburg, PA Mall down to a $21 Million non-recourse loan, while also prolonging the maturity several years. It negotiated $171 Million in additional loan modifications and extensions, while surrendering the keys on 3 properties with $153.7 Million in debt.

You may be asking, this is cool, but isn’t foreclosure bad for CBL? Nope, it’s bad for the lender. You see, CBL has dozens of properties, many of which are in pristine condition and are generating boatloads of cash flow, and some of whom are in trouble and are “cash trapped”, barely able to cover the interest expense and principal payments, much less pay out any cash distributions to CBL. You may initially have a “glass half empty” mentality when hearing this, but you should approach this with a “glass half full” mentality. These properties remit zero cash flow / funds from operation to CBL, but have debt recorded on the balance sheet. Things can only get better, as CBL can walk into the room, put its balls on the table, and tell the lender “Look, we better get a reduction in the interest rate / loan amount and a maturity extension. We have all this debt on our balance sheet and are are getting no cash from this property, if you don’t make a deal with us my secretary will drop the keys off tomorrow”. None of the banks and insurers who lent CBL funds want this to happen, hence just like the Gettysburg example, they try to work out a scenario where CBL has a chance at cash flow, to avoid the a total default. Back to CBL’s story.

Despite CBL’s rapid refinancing and immediate progress in debt paydown / negotiations, CBL’s share price floundered. The conversion of the $150 Million in Senior Convertible notes by CBL into equity just days after going public in Decemeber 2021 took most institutional investors by surprise, and many proceeded to dump their fresh shares onto the open market, as shown below.

By October 2022, CBL was trading at $24, and the board took the very unusual step of instituting a shareholder-rights provision to prevent Antara Capital LP, Cetus Capital, Strategic Value Partners, Oaktree Capital Group, and Canyon Capital Advisors from increasing their position.

In Q4 of 2022, CBL continued it’s breakneck refinancing speed by issuing a new $360 Million Senior First Lien loan at SOFR + 410 bps (at that time just 7.1%) to replace the entirety of the 10% Senior Loan, and issued a $2.20 Special Dividend to reward the shareholders. By the end of the year, they had successfully foreclosed on $150 Million of properties, refinanced / extended more than $1.2 Billion in debt, paid their $884 Million term loan down to $829 Million, and reduced debt from $2.85 Billion to $2.41 Billion.

After beating 2022 guidance across the board (FFO of $442 Million vs $400-$413 guidance, Net Operating Income of $243 Million vs $216.5-$238 guidance), CBL issued strong 2023 guidance (FFO of $418-$441 Million and Net Operating Income of $188-$208 Million) and given additional financial flexibility, hiked the dividend from $0.25 to $0.375.

Despite the bullish outlook, deleveraging, and the dividend increase, CBL shares continued to slide as interest rates edged higher and sentiment around commercial real estate soured. By October 2023, CBL was trading just a hair above $20, less than half its indicative net asset value of $40. The company scraped the shareholder rights plan (allowing Cetus Capital to purchase nearly 1.2 Million shares in the quarter), and instituted a $25 Million repurchase program.

In early 2024, CBL reported excellent year end 2023 results; Funds From Operation of $210 Million handily beat the guide of $188-$208 Million, and Net Operating Income of $441 Million once again exceeded the $418-$440 Million range given. CBL had made excellent progress on the debt negotiations, refinanced $855 Million of borrowings, returned $70 Million of properties to lenders, and reduced debt from $2.41 Billion to $2.36 Billion.

CBL really began to shine in the first 3 quarters of 2024, where opportunistic refinancing reduced overall interest expense, and rising same store sales, occupancy, and positive average rent per square foot developments translated into cold hard cash to the shareholders.

CBL fully completed its $25 Million Share Repurchase program for 1,074,826 shares at $23.26, and also completed a special repurchase in a privately negotiated transaction for 500,000 shares at $25.05 on October 10th. From my understanding, the seller was Strategic Value Partners.

CBL appears to be well on track to achieve full year guidance of Funds From Operation between $196-$210 Million ($6.19 - $6.63 Per Share), and Net Operating Income is likely to come in at the higher range of the $428-$442 Million guide. After the sale of two properties debt fell to an all time low, $2.179 Billion (a decrease of $181 Million YTD), and leverage of Debt / Net Operating Income sits at 4.97x, significantly lower than last year at 5.38x. The two properties, located in Utah, were pledged as collateral for the Term Loan, which was promptly paid down to $730 Million.

Recently, CBL has been taking advantage of renewed interest in Commercial Real Estate. It refinanced a 8.2% recourse loan on its Melbourne, FL property to a 5.86% non-recourse loan that matures in 2034 and extended its Bluegrass, KY loan to 2034 as well, while taking out an additional $4.4 Million in cash, bringing the total balance to $66 Million.

The bottom line is CBL’s focus on deleveraging is finally paying dividends (along with the stock - haha, I am so funny). Its significantly improved leverage profile and renewed fixed income interest in commercial real estate is enabling it to take out additional equity at many of its properties, which it can use to efficiently allocate capital by either repurchase its severely undervalued shares, or paying down more of the higher yield floating rate term loan (SOFR + 275), saving additional interest expense.

Occupancy in the most recent quarter increased from 88.7% to 89.3%, a welcome improvement, and more gains are anticipated in the next two quarters as Rue 21 is set to open 14 locations in Q4 and Q1 of 2025. The leasing spread between expiring leases and renewals / new leases is hitting record highs, with rent increases of approximately 9% thus far in 2024, the first positive change in years. Same-tenant sales are also up for the first time in years (1.5% vs the prior year period), painting an oddly rosy picture for a company that trades at what is clearly a distressed multiple relative to peers.

2. Ownership Structure

CBL’s largest holders are distressed debt / equity specialists. Cetus Capital was a significant buyer last year, adding 1.1 Million shares to their stake, and Howard Amster, a significant individual investor, added 386,000 shares in the most recent quarter. He had excellent timing purchasing his 2.3 Million shares near the 2023 lows of $20, and he currently owns a significant chunk of Onity and a variety of deep value names, but that is a conversation for another time.

I like the activeness of the distressed experts. Cetus Capital adding a Million shares near the October 2023 lows (after the shareholders rights pact expired) indicates to me they are closely monitoring their CBL position. Relative to overall executive compensation of $12.78 Million, I would like to see higher levels of management ownership, but given funds like Canyon Capital Advisors have board representation and that capital allocation has been excellent thus far, I am confident the management team will continue to deleverage the balance sheet, and return capital to shareholders.

3. Property Overview, Geography

The vast majority of CBL’s portfolio resides in the South, with a smaller presence in the Atlantic and Mid-West regions, and a very minor presence on the West Cost.

St. Louis, MO, Chattanooga, TN, Laredo, TX, Lexington, KY, and Greensboro, NC account for 23.7% of CBL’s revenues. In recent years, CBL has reduced its exposure in the Atlantic region, foreclosing upon non-recourse properties in Spartanburg, SC, Burlington, NC, and Chesapeake, VA.

CBL’s 83 property portfolio is primarily comprised of low-mid tier malls, with a smaller portfolio of higher-end Open-Air Centers / Lifestyle Centers, who generate significantly higher rents and account for approximately 25% of net operating income.

CBL’s has a diverse array of tenants, with no single tenant comprises more than 3% of revenue; all of the top 10 tenants are sizable companies with no immediate credit issues. Rue 21, a previous tenant, is set to open 14 locations encompassing 90,000 square feet in retail space, by Q1 2025, and will likely re-join the top 25 tenant list.

4. Financial Analysis

1. Impact of Lower Rates

CBL stands to benefit significantly from a falling rate environment, due to the $971 Million it has in floating rate term loans. The recent 75 basis points in cuts will generate an immediate $7.3 Million annual reduction in interest expense, reducing overall interest expense by 4.55%. This is a welcome development, remember, CBL’s floating rate borrowings are tied to SOFR, not the 5-Year or 10-Year, so even if medium-term interest rates remain higher for longer, this has no immediate impact on CBL.

Given the first 50 basis point cut occurred right before the end of Q3, and the 25 basis point cut two weeks ago occurred in Q4, the impact of these cuts has not yet been reflected in CBL’s financial results. I am unsure of how many cuts we will get next year, if any, but the market seems to imply at least two cuts by next June, which would help reduce overall interest expense by an additional than 3%, and boost funds from operation from $200 Million a year to $214 Million a year.

It’s important to understand that the benefit of lower rates for CBL is even more significant than it may seem with regard to capital returns. Although CBL generates funds from operation of roughly $200 Million a year, its discretionary cash flow is just $67 Million a year.

You might be asking, what is the difference between Funds From Operation and Discretionary Cash Flow? I probably should’ve started off with this earlier, but CBL generates Net Operating Income (Rental Revenues less operating expenses and taxes) of $400 Million a year. You can’t evaluate a REIT of Net Operating Income alone, as you need to factor in leverage, interest expense. CBL’s Funds From Operation, which takes into this into account, is roughly $203 Million a year.

Still, Funds From Operation doesn’t paint the whole picture, as you need to account for maintenance capital expenditures, and redevelopment expenses. 2024 maintenance capital expenditures and redevelopment expenses are estimated to be $56 Million, leaving CBL with $147 Million in cash flow to play around with.

That’s not all, as under the covenants of the term loan CBL has to pay $70-$80 Million towards the principal balance each year. As a result, despite generating $147 Million of cash (which represents a Free Cash Flow yield of 17% at the current price), CBL has only $67 Million in Discretionary Cash Flow as $80 Million goes towards paying down the term loan.

As a result, the $7.3 Million reduction in annual interest expense as a result of lower rates has is much more significant than it would initially appear. This added $7.3 Million will boost CBL’s annual discretionary war chest by 10.8%, paving the way for additional share repurchases or perhaps a dividend hike, and will mean that 2025 will likely be the first year of growing Discretionary Cash Flow since CBL emerged from bankruptcy.

CBL’s capital allocation thus far has been excellent. This year, they are on track to return $36 Million to shareholders in the form of repurchases, $48 Million in dividends, and are quickly refinancing debt to lower interest costs. Simply put, CBL is already putting the pedal to the medal by returning all of its discretionary cash flow to shareholders, as a result, it isn’t unreasonable to think this $7.3 Million in interest expense savings will also be used next year to help correct the discount between CBL’s share price and peers, ideally in the form of additional share repurchases.

2. Occupancy / Rent Levels

Occupancy at CBL’s properties is improving. CBL’s higher-end Lifestyle Centers (which have a town-square feel) and Open-Air centers continue to head towards fresh highs, and CBL’s lower-end Malls are set for significant improvements in occupancy as previous tenants emerge from bankruptcy and are set to re-open more than 94,000 square feet of retail space in Q4 (primarily Rue 21). I always liked how their jeans looked on this one girl I knew. Unrelated.

In recent years, CBL has invested heavily in redeveloping many of its properties to create an experiential feel. This sounds like a buzzword, but CBL is executing, it has transformed many existing vacancies that were previously operated by retail names such as Dick’s Sporting Goods, into experiential locations such as a Planet Fitness or even a Penn National Gaming poker room. While this redevelopment comes at an upfront cost, it attracts higher grade tenants, and more importantly, increases foot traffic to the other tenants (restaurants and stores) at these locations, increasing the overall value of the properties. This has led to the first period of consistent Same-Center Sales per Square Foot (what a mouthful) growth in recent years, and has also enabled CBL to finally get aggressive with tenant renewals, as its locations are significantly more attractive now than they were just a few years ago.

The proof is in the numbers, as CBL is no longer giving lease concessions / reductions to its tenants and in fact increasing rents around 9% a year. This has been especially pronounced in the leasing spread for “New Leases”, where a new tenant takes over what is usually a previously vacant location. Doesn’t quite seem like “retail must be dead”, does it?

3. Returning “Cash Trapped” Properties

An overlooked aspect of CBL is that $582 Million in debt (23% of the overall $2.486 Billion debt burden) is attributable to cash trapped properties. These cash trapped properties generate essentially zero cash flow for CBL (aside from $1-$2 Million in management fees), as they cannot generate enough cash flow to pay off the interest and principal on the mortgages against them, and thus CBL is prohibited by the terms of the loan from paying itself distributions. These properties as non-recourse properties, meaning that lenders can only get the property back from CBL, nothing more.

As a result, CBL has substantial optionality. If these properties turn around, and occupancy and sales increase, there is a small chance the properties will generate enough cash flow to finally pay CBL cash distributions, thus increasing Funds From Operation. If they do not, CBL can simply return the properties to the lender, and reduce its debt burden by 23% while generating essentially no negative impact on Funds From Operation.

The banks / insurers who lent CBL money are terrified of taking ownership of these properties. As a result, CBL has an implied call option; as the loans on these properties mature in 2025, 2026, and 2027, CBL will demand significant concessions in the interest rate, principal amount, and maturity date. Since CBL is extracting zero cash from these properties, they will be highly aggressive in negotiations, as just like in the Gettysburg Mall negotiation, they literally have nothing to lose. They can charge of 23% of debt with minimal impact on cash flow to the shareholders, and as a result, unlike Tanger, Macerich, Simon Property Realty, and Kimco, CBL’s leverage ratio is significantly lower than it appears, as a sizable portion of debt is non-recourse borrowings attributable to properties CBL can simply walk away from. People screw lenders over all the time. Is Karma real? Who cares, if someones going to do it, it might as well be the name we own right?

4. Adjusting Out “Debt Discount” Accretion

Similar to IGI not screening well because Bloomberg had incorrect financials on it, CBL is interesting in that a Debt Discount Accretion adjustment is required to accurately measure Funds From Operation.

As part of its restructuring, CBL marked the Senior Term Loan below par, and makes a quarterly adjustment to bring it closer to par value. In terms of accounting, this adjustment is recorded as a non-cash interest expense, and thus directly impacts Raw Funds From Operation. As a result, CBL might report a quarterly FFO figure of $30 Million and an adjusted figure of $50 Million, but anyone looking at first glance might deduce some funky adjustments are going on and become dissuaded from looking further. I dislike companies that adjust numbers so significantly, but in this case it makes perfect sense since the adjustment to par is a non-cash interest expense, the term loan itself is trading at 93 cents on the dollar, and anyone who is evaluating CBL will look at the face value of the debt and ignore the adjustment entirely.

These adjustments are set to stop late next year anyways, so CBL’s raw FFO figure will increase significantly, thus helping it screen better, although this really shouldn’t matter anyways.

5. Management Consistency and Guidance Accuracy

CBL management has regularly provided accurate guidance, and CBL itself tends to to consistently come in at the higher end. While you shouldn’t hand management a gold medal for being good at their jobs, I think the accuracy of guidance is something to acknowledge. Given CBL trades at just a third of the valuation peers do, I think the bear case assumes something is wrong or inconsistent with the guidance provided, otherwise CBL trading at a third of the valuation comparable peers do simply makes no sense.

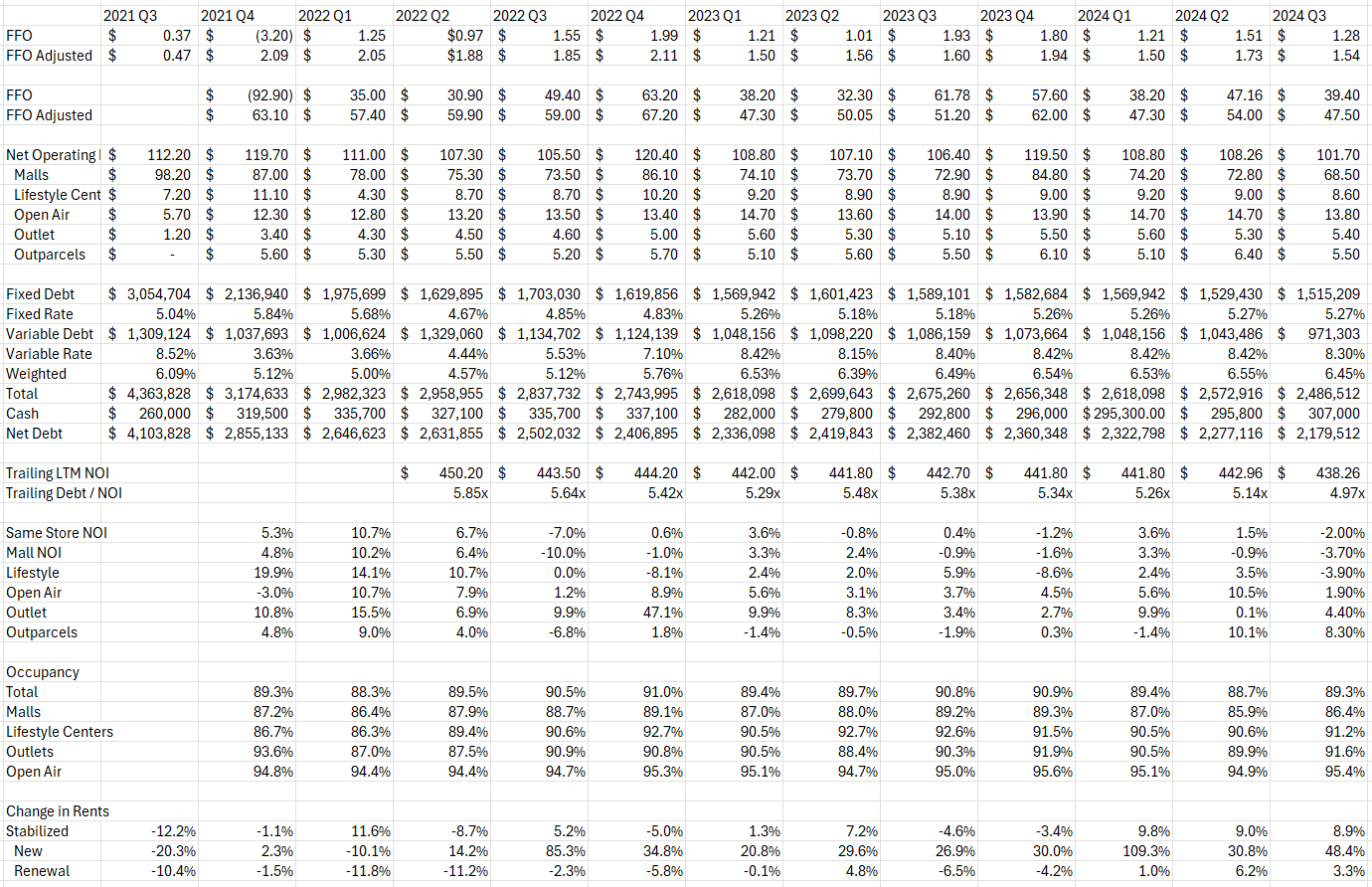

For your convenience, below is a summary of CBL’s historical financial performance.

5. Capital Returns

CBL has been pressing the attack on share repurchases and dividends, completing the $25 Million repurchase program this year ($1 Million was executed in Q4 of 2023) in addition to a $12.5 Million special repurchase. It is also on track to pay out $48 Million of dividends this year, translating into total shareholder returns of $85 Million, significantly higher than the $67 Million in discretionary cash flow it is generating.

Given the valuation CBL is currently trading at, you might be wondering why CBL isn’t using more of its $307 Million in cash. That has to do with the way CBL is structured.

CBL is a holding company, it has about $500 Million in Real Estate on the Holding Company balance sheet, and of course the $730 Million term loan. As of last quarter, it only has $21 Million of cash on the Holding Company balance sheet. The vast majority of its assets are actually Joint-Ventures with firms such as Brookfield and Oaktree, where it owns a 50% stake in the properties. As a result, it consolidates the cash onto its balance sheet, but that $280 Million in cash is not yet at CBL’s disposal, since it is not at the Holding Company. As a result, they must wait for the cash to be distributed before being able to use it to repurchase shares. You may see this as a negative, but given CBL is operating with such little cash at the Holding Company level, it is indicative of how truly undervalued CBL management believes the shares are. They are using all cash at their disposal to repurchase shares, and are even refinancing existing properties to take out additional cash. For example, CBL refinanced the Outlet Shoppes at Bluegrass, which is held at the holding company level, from $61.5 Million to $66 Million to generate an addition $4.5 Million in cash for further capital returns.

Given the company went out of its way to repurchase shares at $25 just a few weeks ago, I think the risk to reward is attractive. Just like IGI at $10 a share when the company was repurchasing blocks at $8, I think if CBL falls 10-15% from the current level, the company will take quick action to repurchase shares, which would blunt further downwards movement. Given Funds From Operation and Discretionary Cash Flow are set to rebound next year, I think the company will initiate a fresh repurchase authorization, as it is still trading at a deep discount to the $44 a share Indicative NAV calculated by the management team. I think you could make a strong argument the $44 a share Indicative NAV value itself is understated, because it uses a 15% implied Cap Rate to calculate the value of the Real Estate. Given many of the Sun-Belt properties are being refinanced at just 5.8%, I think CBL likely has many properties which could probably fetch an 8-10% cap rate, and also some properties that are in disarray and worth a 16-18% cap rate. This is actually highly beneficial to CBL, as it can simply walk away from those properties given most of its debt is non-recourse. As a result, is it really fair to put a blanket cap rate of 15% on all of CBL’s properties? I don’t think so, and I think the management team would also agree given how quickly they have been buying back stock.

6. Relative Valuation

I usually don’t spend too much time on relative valuation, however I think in this case it is very pertinent as CBL is trading at a mammoth discount to peers on a Funds From Operation and Free Cash Flow basis, despite having a substantially similar leverage profile and in the case of Tanger, very similar quality properties.

Before getting into the metrics, I wanted to take a birds-eye overview of market sentiment towards Retail Real Estate. Despite the “Retail is Finished” prognostications we hear constantly, Simon, Kimco, Macerich, and Tanger have risen over the past two years to valuations we have not seen since 2016. This is even funnier when you consider the fact that Simon Property Group had to buy its anchor tenant, JC Penney, in 2021 to stave off a bankruptcy that would’ve severly impacted its Occupancy figures. While I give them credit for quick thinking, should a REIT that has to purchase anchor tenants to stave off bankruptcy trade at 3.5x the valuation of a REIT that is ferociously paying down and repurchasing shares? I guess that’s really up to you..

On a leverage profile, CBL trades right in-line with peers, In fact, as we previously discussed, the actual Net Debt / EBITDA ratio is probably closer to 4.5x, as more than $500 Million of non-recourse debt is attributable to properties that do not generate cash. CBL can simply walk away from these properties at no real loss to the shareholders (aside from the $1-$2 Million in management fees it generates).

CBL has a significantly higher cost of debt than competitors, but this is due to CBL’s disproportionately large use of floating rate term loans and per-property non-recourse borrowings, which carry a higher interest rate as they afford CBL the optionality of returning properties that are underperforming. CBL has used this structure to its advantage, consistently demanding principle reductions and interest rate adjustments as unlike SPG, MAC, KIM, and SKT, who borrow at the parent-level and thus have to eat the loss on most properties, CBL can simply walk away. Additionally, the recent 75 bps in cuts haven’t yet been reflected in CBL’s financials, by the end of the year, CBL’s overall borrowing cost will be much closer to 6%, and additionally, that interest rates ascribed to CBL’s recent refinancings are in-line with peers.

CBL’s maturity profile is also in-line with peers. While 40% of debt maturing by 2027 may seem high, CBL is actually in a much better position than names like Macerich and Tanger, who have a lot of 3-4% borrowings that will re-price higher. If anything, I think CBL’s $735 Million term loan, which trades at SOFR + 275 will actually re-price lower. At part of the bankruptcy proceedings, CBL had to agree to not re-purchase any portion of the Term Loan before maturity, preventing it from buying the loan at the current 93 cents on the dollar. Without this covenant, I think CBL would be expeditiously repurchasing the term loan, and thus it would be trading way closer to par. While CBL’s equity trades at a distressed multiple implying a cap rate upwards of 18%, CBL debt trades almost exactly at par, implying the bond market is not concerned about credit at all.

This disconnect is especially astounding once you realize CBLs implied cap rate of 18% is wildly above peers such as Tanger, who owns substantially similar Class B and Class C Strip Malls.

I think the discount to peers is best exemplified by CBL’s shockingly high implied cap rate, and low Price to Funds from Operation Relative to Peers.

The valuation gap is stunning. While you can certainly make the argument Kimco or Macerich has higher quality properties than CBL, the cap-rate differential cannot be explained, or seen anywhere else within publicly traded REITs. Even troubled Medical REIT Medical Properties Trust, which is slashing its dividend and has credit default swaps trading through the roof, demands a higher P/FFO ratio than CBL, which is especially astounding as CBL is not a cash-trapped name and is paying a growing dividend in addition to returning large amounts of cash through repurchases.

CBL is finally turning the page on a dark chapter; it is improving occupancy levels and recording record rent increases, and is accomplishing this amid a very favorable backdrop of falling short-term rates which will directly translate into higher Discretionary Cash Flow. I have spoken to a few people who specialize in REITs, and all were surprised to learn that CBL is back in business. Similar to Talen Energy trading at a P/E of 8 for a few months (before their sizeable repurchase attracted significant attention), or Sila Realty Trust trading at 7.8x FFO prior to their tender offer, I think CBL has taken the right capital allocation steps, but has somehow managed to fly everyone’s radar. Very few people are aware it exists.

7. Risks

I think the obvious risks to CBL is overall economic stress. CBL has a diversified base of tenants, and given the relatively predictable nature of rental income, I think the only thing that can really impact CBL, absent a full blown recession, is sentiment towards commercial real estat, and of overall interest rates.

It’s unlikely we see a hike next year, as the market is ascribing close to a 0% chance of that happening, however, a resilient 10-Year yield will obviously create a smaller window for CBL to continue refinancing fixed rate debt lower.

Of course, a sudden recession would severely impact retail sales and lower the credit quality of CBL’s tenants, but given the strength of consumer spending, rising same-center sales, and overall demand for junk debt, I don’t really see what could plunge the US economy into a recession next year. Then again, does anyone ever see it coming? Maybe Robert Kiyosaki, but he’s been right 28 out of the last 5 times.

Overall concerns about Commercial Real Estate impact CBL, but I think the main areas of stress moving forward are Office Buildings, not Retail Centered Real Estate. If market is any indication, concerns over Retail Real Estate have entirely evaporate, as previously “distressed” names like Tanger and Simon have doubled and tripled since October 2022. I understand having a bearish view on Retail Real Estate valuations, but if that were the case, why bet against a name trading at 4x FFO who is returning cash to shareholders through significant repurchases, versus betting against companies that have already run from 8x-9x all the way to 14x-17x, despite no real change in fundamentals?

8. Position and Conclusion

The truth is people are social creatures. As Patrice O’Neal, one of my favorite comedians once said, people want to be left alone, but they don’t want to be lonely. Kind of like falling in love for 15 minutes at the airport, it’s fun to go to malls and see stores, fashion, and people. The fact Simon, Tanger, and Macerich are up anywhere from 100-300% over the last two years is confirmation the attitude towards Mall Real Estate has softened significantly, and this is especially obvious given the dog of Retail REITs, Tanger, has risen from a P/FFO of 8x to 17x.

There is an astounding disconnect between the bond market and equity market on CBL. Would distressed specialists really be willing to pay close to par on CBL’s borrowings if they truly thought CBL equity trading at a Free Cash Flow yield of 17% is accurate? It’s possible, but I think the more likely conclusion is they have realized CBL’s cash flow and debt profile have improve significantly over the last two years, and rather, CBL’s thin liquidity and lack of name recognition have caused the equity to avoid detection.

It isn’t just that CBL trades at a third of the valuation peers do, who cares what the peers are trading it? CBL itself trades at a Free Cash Flow yield of 17%, a Discretionary Cash Flow yield of 9%, and has a proven track record of returning cash to shareholders.

It’s easy to sit in a Herman Miller chair in a quarter zip, and opine “Retail is dead”. But eventually, the numbers tell the story, and it is clear through rising occupancy, turning Same-Center sales, the first rent increases in years, and a management team going out of its way to secure cash to repurchase additional shares, that the story is changing. CBL has a significantly higher short interest ratio than peers, nearly 16% of the float, and given CBL has no convertible debt and the holders of the term loan are all shareholders as well, I think CBL has inadvertently wound up being the “short leg” in many “death of retail” baskets, despite its strengthening fundamentals and the ridiculously low valuation it trades at.

With the management team was conducting special share repurchases at $25, at a price of $27, I think the risk-to-reward is attractive. At a P/FFO of just 4.1x, you have significant upside potential, and any move downwards to $25 will likely to be followed by significant share repurchases, stunting a further move down.

What’s a fair value for $CBL? I’m not really sure. Will CBL 0.00%↑ come in at the higher end of the $6.19 to $6.63 FFO range for this year? I’m also not sure. Will CBL ever demand a multiple similar to peers, or even trade at 6 or 7x (which would imply $38 to $44)? I also do not know.

But as long as the cash continues to roll in, interest expense declines, and CBL is able to keep repurchasing shares more than 30% below its Net Asset Value, is CBL really worth just a Free Cash Flow yield of 17% and just 4.1x FFO? I think not.

I think CBL 0.00%↑ at $27.29 represents an attractive opportunity to gain exposure to Retail Real Estate alongside distressed funds and a management team that have more than half a Billion at stake, at a rock bottom valuation.

In a world where most REITs try to sell you 17x FFO as a “Reasonable” and have nothing more to discuss than a slightly improving dividend payout ratio, I think CBL with an aligned management team, impressive capital returns, and a Price to Funds From Operation of 4.1x, is worth considering.

9. Position

Long 14,200 shares at $27.26

Once again, not advice.