In a World Full of 50's, A Beautiful 5- $IGIC, You Decide

International General Insurance - The Little Insurer That Could Pt. 2

Disclaimer: Before we get to the fun stuff. This post is not financial advice, and not a solicitation to purchase or sell securities. You should conduct extensive research before engaging in any type of investment decision, and consult a financial advisor / tax advisor. As a reminder, this article is written by a guy impersontingg a decades old movie character online, it should not be taken seriously. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the post before making any decisions based on such information. By reading this post, you acknowledge that the opinions expressed herein may be highly inaccurate and unfounded, that this article is for informational, educational purposes only, and to indemnify and hold harmless the author (me) from any claims / actions arising from your reading / sharing of this article.

The content herein is the exclusive content of Chief’s Substack, All Rights Reserved.

The article is an expanded thesis of the original tweet

Quick Stats:

Name: International General Insurance ($IGIC)

Sector: Diversified Insurance

Price: $15.80

Forward PE: 5.3x

Price to Tangible Book: 1.16x

Insider Ownership: 42.87%

Market Cap: $722 Million

5 Year Net Income CAGR: 34%

5 Year Gross Written Premium CAGR: 15%

Quick Pitch:

In a world of 50’s, a beautiful Five. As Rollins, Costco, Cintas, etc barrel towards the 50x P/E mark on account of “Perpetual Growth”, “Quality”, “Too Big to Compete With”, and “There’s Nothing Else to Buy”, it’s become increasingly challenging to find competently run companies at attractive valuations (much less at a single digit P/E), unless they are rooted in declining industries, burdened by indebted balance sheets, or have a general hatred of shareholders (looking at you, Greek Tankers and most Regional Banks). $IGIC, in my opinion, bucks this trend.

International General Insurance is a growth name trading at a deep value multiple (5.2x 2024 P/E, 1.15x Tangible Book). Over the past two decades, its highly invested father-son management team have driven a wildly profitable international expansion rooted in a culture that puts risk-mitigation first. Unlike most insurers, IGI operates with no debt and an extremely conservative short-duration investment portfolio that minimizes interest rate (20% Cash / CDs, 80% Fixed Income, Weighted Yield: 4.2%, Duration: 3.1 years) and positions IGI as a a clear beneficiary of higher for longer.

IGI’s deeply invested founders, Chairman Wasef Jabsheh and his son Waleed Jabsheh, own 14,900,000 shares ($223 Million, 33.6% of the company) and have an exceptional understanding of capital markets. The company was taken public in 2020 through a SPAC transaction, and promptly left for dead after COVID ravaged the energy and insurance markets. IGI not only maintained profitability, it improved its international diversification, establishing a foothold in the United States, growing its presence in the United Kingdom and making a strong entry into the global reinsurance market.

Despite earnings steadily improving from 69 cents in 2020 to $1.74 in 2022 and book value jumping to $9 a share, the share price remained unmoved at $8 (likely due to the small float held by mostly retail investors). The management team was well aware the company was deeply undervalued (Waleed Jabsheh got on a podcast and said “I am deeply dissatisfied with the stock price”), and shifted the capital allocation strategy by slashing the variable dividend to 1 penny, and launching a 5 Million share repurchase program and promptly repurchasing 4 Million shares at $8.

By Q2 of 2023, the cat was out of the bag. IGI’s international expansion and the “hard” reinsurance market was propelling earnings to record levels, and IGIC stock was rapidly barrelling towards the $11.50 SPAC Warrant Strike Price. The management team astutely shifted the capital allocation policy once again, temporarily pausing share repurchases in Q3, and instead repurchasing 16.5 Million SPAC warrants for $0.95 (600,000 warrants were exercised).

IGI reported record earnings of $2.58 in 2023, but the beauty of IGI is it focuses on short-tail insurance, which provides much more freedom with earnings / cash flow as the scale of claims and losses become apparent on a shorter timeline, and thus easier to estimate than something like life insurance, which is long-tail. With a clean balance sheet, significant excess capital, and incredible 2024 H1 EPS of $1.51, IGI has resumed it’s focus on returning cash to shareholders, repurchasing 600,000 shares in H1 2024, paying a special $0.50 dividend, hiking the regular dividend to 2.5 cents, and announcing a fresh 2.5 Million share buyback authorization in June.

Despite IGI’s incredible track record and shareholder-first capital allocation policy, IGIC 0.00%↑ trades at a depressed multiple relative to peers, and obviously the general market.

This is likely due to multiple factors:

No Institutional Coverage (other than RBC)

SPAC “Birthmark”

Middle-East Connection

Low Float (Roughly 5 Million shares)

While many of these concerns are reasonable to have, all are unfounded.

IGI was not born from a regular SPAC, it consummated a merger with a purpose-built insurance SPAC, Tiberius Acqusition Corp, run by seasoned insurance industry executives who have not only maintained their original position in IGIC, but purchased an additional 300,000 shares this year. IGI is also not a Middle-Eastern shitco, the Middle-East accounts for just 9% of Gross Written Premium, and aside from a back-office in Jordan to process claims, most of IGI’s underwriters are located abroad in London, Casablanca, Dubai, and Bermuda, and the IGI holding company itself is not subject to Middle-East law.

The Low-Float and Lack of Institutional Coverage is an issue, but also provides an opportunity. IGIC is up nearly 90% over the last 12 months, but has caught the attention of just one equity research analyst and still trades at a P/E of 5.2 and a minimal premium over tangible book value.

No one has heard of IGI.

Imagine what the stock could do if IGI gets some time in the spotlight…

With its conservatively positioned balance sheet, rapid growth in U.S. E&S, Construction Liability, and Energy lines, a massive repurchase authorization that represents nearly 50% of the float, a proven track-record of excellent capital allocation, and a dedicated management team that prioritizes risk management and has its balls on the table to the tune of $223 Million, IGI is simply too cheap at 5.2x P/E and just 15% over book to ignore. IGI offers an attractive opportunity to gain exposure to the insurance industry at a rock-bottom valuation where the management team treats the shareholder like partners. In a world of 50’s, IGI is a beautiful 5(x).

Table of Contents

Company History, Structure

Legal Structure

Ownership Structure

Geographical Distribution of Premium, Segments

Financial Analysis – “Everything Isn’t As It Seems”

Earnings

Balance Sheet Conservatism

Lack of Leverage

Limited Interest Rate Risk – Equity Understated

Historical Loss Reserves Continually Prove Conservative

Cluseau, the “Mental Gymnast”

Adjusted Income Statement

Industry Relative Comparison / Absolute Analysis

Growth Avenues

Risks

Why (I believe) $IGIC Isn’t a Value Trap

Position and Conclusion

1. Company History

Founded in 2002 by Wasef Jabsheh and his two sons, International General Insurance has transformed from a sleepy Jordanian provider of short-tail energy insurance in the Middle East ($24.89 Million in 2005), to an internationally recognized provider of specialty short tail (energy, marine cargo, political violence), long-tail (professional indemnity, marine liability, inherent defects), and reinsurance across all continents ($688 Million in premium, 2023).

In 2007, IGI expanded underwriting operations to the United Kingdom, purchasing 51% of SR Bishop Underwriting. In 2009, IGI acquired the remainder of SR Bishop, and rebranded it as North Star underwriting.

IGI acquired Specialty Malls Investment Co. in 2009 for $22 Million, which owned an assortment of Real Estate and Malls in Jordan and Lebanon. The acquisition was a mistake, and by 2024 IGI had written off nearly all of the purchase price (Real Estate currently comprises just $4 Million of IGI $1.833 Billion in assets).

By 2013, Gross Written Premiums had increased to $240 Million, and IGI set its sights on shifting away from the Middle-East (Energy Insurance, $111 Million in premium), and establishing a foothold in mainland Europe (at the time just $42 Million) and North America ($2 Million).

By 2017, IGI’s International expansion was making incredible progress, the Middle-East fell from 44% to just 15% of gross written premiums, and IGI’s European and South American arms comprised more than 50% as diversified lines such as Director’s Indemnity, Ports & Terminals, Aviation, and Property supplanted IGI’s traditional focus on Energy. Nonetheless, IGI still wasn’t able to establish a beachhead in North America. North American premiums amounted to just $1,140,000, less than 1% of overall business.

2019 marked a pivotal year for IGI. Gross premiums soared 17% from 2018, but more importantly, IGI finally established a presence in the U.S. and Mexican Energy Insurance markets. Premiums inflecting sharply from $859,000 to $4,200,000, and IGI sensed opportunity.

Now, you may be asking why North American growth is so important to the story. North American growth has been the primary driver behind IGI’s incredible expansion, and increase in profitability over the past few years. With competitively lower costs, as a portion of underwriters and most of the back office is located in Jordan (where salaries are obviously lower), and likely a lean and mean sweatshop culture as the family-run management team avoided the typical white-collar office politics that occur at most financial firms, IGI realized it could easily undercut obese, overpaid, and inept American insurers, just as Kinsale Capital has within E&S Lines specifically (graph of North American premium below).

Hungry, and in need of extra capital, IGI consumated a merger with Tiberius Acqusition Corp in February, 2020, just two weeks before the Wuhan Flu.

Tiberius Acqusition Corp was a purpose-built insurance SPAC run by Michael Gray (CEO, Gray Insurance CompanyAssociataion) and Andrew Poole (Diamondback Capital Management, SAC Capital and Swiss Reinsurance). The transaction was beneficial to both parties, as it provided Tiberius an opportunity to buy-in to a growing insurer below peer multiples, and offered the Jabsheh family and other insiders a liquidity event to cash in a small portion of their shares at double book value. Ultimately, Wasef Jabsheh, the chairman, sold a portion of his shares, going from 17 Million to 13.4 Million. Other investors, such as Ominvest (the Omani International Investment Fund), also sold 20-25% of their holdings.

In March 2020, the Wuhan Flu struck, and IGI was pummuled to the Maxine Waters IQ Level (~$5). Investors wrongfully assumed issues with IGI’s investment portfolio (which at the time included a lot of emerging market bonds), and also assumed the oil / energy industry, which accounted for 19% of gross premiums), was dead.

This was not the case.

IGI continued it’s steady trek upwards, achieving record Net Income in 2021 and 2022.

The earnings were incredible, the reaction was lethargic. The SPAC squad had no interest in sticking around, and everyone seemed to be dumping shares on the open market (see below).

IGI knew it was wildly undervalued at a P/E of 4, slightly below book, and with significant growth on the horizon. It authorized a 5 Million share repurchase program in May of 2022, and purchased 310,000 shares on the open market in 2022, and started 2023 off with a bang (private transaction to purchase 2,271,775 shares at $8.60). A detailed table of the repurchase progress is below:

Within the last six quarters, IGI has spent $44 Million repurchasing it’s (undervalued) shares at an average price of $9.78, and also taken out 16,552,030 highly dilutive warrants at a cost of $15 Million. It is important to note the 2024 Q2 figure was given as of June 11th, so the exact repurchase price is an estimate, and the total quantity of shares purchased may indeed be higher. One thing is for sure, Wasef Jabsheh promised meaningful share repurchases, and he delivered.

In 2022, IGI completed the acqusition of MGA Energy Oslo, which it had been doing business with since 2009. An MGA, managing general agent, is a specialized insurance broker that not only connects customers with insurance companies, it actually underwrites the policy and determines how much the policy should cost. By purchasing MGA Energy Oslo, IGI solidifed its growing presence in the Nordic region, and also gained extra control to ensure underwriting standards continue delivering delicious margins.

One of the issues with most MGA’s is that MGA’s operate with minimal risk, they get paid a brokerage fee by the underlying insurer, and the insurer bears all the risk on the policy. As a result, a perverse incentive arises. The MGA knows it gets paid no matter what, so in some cases they may underwrite a policy at a low rate for a shady customer, simply because they get paid a commission and if something goes wrong, “it’s not our problem” (looking at you Fidelis, lol). By purchasing the MGA, IGI ensures all the incentives align.

Just weeks ago (June), IGI was granted a “box” (office) to begin underwriting at Lloyd’s of London, arguably the world’s most prestigious insurance marketplace. This incredible opportunity will allow IGI to gain color on market trends, distribute their products to a much wider audience, and help elevate IGI’s Reinsurance aspirations to the next level. Simply put, being able to say you has a box at Lloyd’s is like an OTC name graduating straight to the Nasdaq 100.

IGI has a tiny box (30A), on the third floor to be exact, but something tells me they are just getting started…

2. Legal Structure

I think it is important to understand that IGI is legally not a Jordanian company, and not subject to rules / laws / politics of the Middle East.

International General Insurance Ltd., the holding company, is domiciled in Bermuda. The Bermudan holding company ($IGIC), owns International General Insurance Holdings Limited DIFC, which is registered in the Dubai International Financial Centre. Corporations in the Dubai International Financial Centre are not subject to UAE jurisdiction (aside from money laundering), as the DIFC is a self-regulated zone.

The Dubai Holding Company owns the U.K., Bermudan, and Jordanian back office arms, and the Bermudan arm is the main holding company for IGI’s individual offices.

Simply put, aside from the back-office being registered in Jordan, none of IGI’s balance sheets or underwriting arms are subject to Jordanian law, and the underwriting arms / holdings companies themselves are located in Bermuda and the Dubai International Finance Centre, both which are highly respected and established. Having the holding company in Bermuda enables IGI to reduce its tax burden as Bermuda does not levy corporate income taxes on income from foreign subsidiaries, and having the individual office legally seperate reduces cross-contamination in the event of litigation.

A full diagram of IGI’s legal structure is below.

3. Ownership Structure – And Commentary

Affiliated Owners / Insiders:

Three long time holders, Church Mutual Insurance, Argo Group International (An Insurer), and Royce Investments own 9.2 Million shares.

Of the 44.3 Million shares in circulation, 30 Million are owned by the management team / Ominvest / SPAC directors (Gray, Poole), and an additional 9.2 Million shares are owned by other insurers and Royce who participated in the SPAC. As a result, of the 44 Million shares, only 5 Million are truly circulating.

With this in mind, it’s not hard to see why IGI was underpriced for so long: not only have very view heard of it, but the institutional investors who did likely figured it would be impossible to buy anyways. With an average volume of just 100,000 shares a day, a large buyer would become more recognizable than a Uighur wearing a Winnie the Pooh costume in Xinjiang.

While this lack of liquidity is an issue, it does mean the new 2.5 Million share repurchase will have an amplified effect, and perhaps even provide significant downside protection as I’m if the company is happy to buy back stock 10% above book, they’re going to love buying it back right at book.

Remaining Spac Baggage / Earnout Shares:

As of Q1 2024, there are 1,012,500 “Earnout” shares that vest to the founders / spac insiders if $IGIC achieves a 30-day VWAP above $15.25 by 2027, and 1,020,665 RSU’s issued to employees / the management team.

The earnout share incentive structure, in my opinion, shouldn’t actually be thought of as SPAC baggage – it has time and time incentivized the management team to avoid pulling stupid maneuvers, and remain laser focused on redirecting IGIC’s opulent FCF towards share repurchases, which is my preferred method of capital returns.

Many FIG funds may sneer when they see IGI was once as SPAC, but as shown through IGI’s capital return initiatives, IGI is likely the only “SPAC Shitco” to hold the impressive title of “Avoided Warrant Dilution and Reduced the Share Count”.

Not to mention that the SPAC insiders themselves have remained invested and even increased their holdings (Gray Insurance purchased 300,000 shares in 2024 Q1).

Points to the IGI management team for IGI’s incredible growth and excellent capital allocation. Then again, when you are growing and at a P/E of 4-5, you’d have to be Hank Johnson “Guam Will Tip Over” level intelligence to not be buying back like a Mad Hatter (Don’t get mad at me, he’s the one who said it:).

4. Geographical Distribution of Premium, Segments

An easy-to-spot concern about IGI is the Middle-Eastern origin. When IGI was founded in 2002, 57% of Gross Written Premium originated from the Middle-East / Asia, but as mentioned previously, International expansion has reduced that figure to just 9%. IGI has grown from 287 employees in 2021 to 401 employees in 2023, and has a distinct competitive advantage in having a back office located in Amman, Jordan, which greatly helps reduce overhead costs.

Nonetheless, IGI’s focus is on International expansion, and as a result the vast majority of it’s new underwriters are in growth outposts in London, Dubai, Casablanca, and most recently, Bermuda.

Since I haven’t shown a colorful photograph in a few paragraphs, below is a graph of the geographical location of IGI’s underwriters:

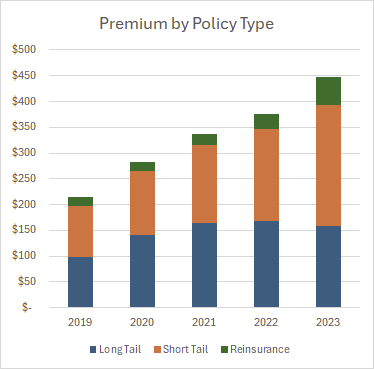

The primary bread and butter of IGI is short-tail insurance (53% of net written premium, 59% of earnings) in lines such as energy, property, construction liability, political violence, and marine cargo. Short-tail insurance refers to the time claims take to surface and resolve, in this case approximately 4 to 7 years. The beauty of short-tail insurance is claims surface quickly and liability is slightly easier to estimate, which helps means that earnings from the short-tail segment are less subject to actuarial adjustments and more readily available to be returned to the shareholders (longer tail insurers, in segments such as life insurance or medical malpractice are more prone to sudden actuarial adjustments, in many cases sandbagging earnings – for example $LNC or “Thames River” being the perpetual capital incinerators they always have been).

35% of net written premium and 31% of earnings come from long-tail insurance, in lines such as directors indemnity, intellectual property, marine liability, and inherent defects. These longer-tail policies can sometimes take more than a decade to settle, and IGI is forecasting both price-pressures and potentially negative growth in these lines this year.

12% of net written premium and 10% of earnings come from reinsurance. The reinsurance market is currently in a hard market. Many reinsurers were ill prepared for the rise in rates, and experienced high catastrophe losses, which in turn incinerated capital from 2020 to 2022. Reinsurance rates have soared, and IGI, wisely sensing opportunity, has expanded reinsurance premiums written from $17 Million in 2019 to $53 Million in 2023, and earnings have in turn exploded from $205,000 in 2019 to $18,700,000 in 2023. In hindsight, using the words “exploded” and “reinsurance” in the same sentence is bad taste, but I doubt anyone’s reading this line.

I think it is especially important to note IGI’s incredible expansion into reinsurance, with profit doubling from $9 Million in 2020 to $19 Million in 2023. It’s especially impressive that a little guy like IGI has been able to expand so rapidly to take advantage of the hard market, and I think IGI’s graduation from a booster seat to a seat at the table at Lloyd’s allows a further opportunity for growth. In the first quarter alone, IGI reported $6.8 Million in profit from reinsurance. With the reinsurance market expected to remain hard for the rest of 2024 and perhaps even the first quarter of 2025, I think IGI has a fair shot at building upon it’s record reinsurance profits last year.

The fastest, and most profitable growth driver is IGI’s expansion into U.S. short-tail Energy, Construction, and E&S Lines. Simply put, IGI has a major competitve advantage in this market:

American Insurers are Fat, Slow, Lazy, Full of Wasteful Initatives and Corporate Ghouls, and Wrought With Office Politics

IGI does not have these issues

Just like $KNSL, IGI is willing to accept lower margins by undercutting the competition, as scale outweighs maintaining high margins

IGI forecasts low teens growth for the short-tail segment this year, slightly faster growth in the United States, and overall improvements in both rates (prices) and volume (number of policies), in keeping with the growth over the past few years (shown below)

While IGI does not break down profit by region, knowing most of the North American business (highlighted in, mahongy?) shown above is short-tail, and that short-tail profits are booming, my magic eight-ball (not drugs, an actual eight-ball) tells me most of the short-tail expansion is IGI absolutely demolishing the competition in the United States. It’s also important to note that the Middle East, which I have highlighted in “Hot Pink” in support of Sydney Sweeney, is continually diminishing as a percentage of total gross written premium.

As shown in the table below, Africa, North America, and the Caribbean Islands remain a significant and above trend source of growth for IGI, with North American Premiums razzling and dazzling from just $2 Million in 2017 to an astounding $89 Million in 2023 (a 45% jump from 2022 levels).

IGI not only geographically diversified, immense growth in Engineering, Marine, and Reinsurance products have further reduced IGI’s reliance on the Energy Sector. A graph of IGI’s growth by type of product is below.

On a side note, it really is difficult to write an insurance article without using the words booming or exploding. If something goes wrong with this pitch, I guess I was kinda asking for it.

Hopefully by now you have a good understanding of IGI’s segments. The takeaways are:

Short-Tail insurance products are more advantageous from an investor perspective than Long-Tail, as earnings are less subject to future “adjustments” as claims resolve faster, and can thus be returned to shareholders sooner

IGI’s fastest growing segments are Construction (Engineering), and E&S within the Short-Tail segment, and Reinsurance

IGI is rapidly capitalizing on its foothold in North America, and using broad International growth to diversify away from the Middle-East

IGI has experienced immesne Reinsurance growth in the first quarter. If Q1 Reinsurance profit of $6.8 Million is indicative of the overall year, IGI is well on its way to exceed $19.8 Million in Reinsurance profit last year

5. Financial Valuation

A) Earnings

“Slow, sexy, and steady” best describes IGI’s growth since 2002. Aside from a small loss in 2008 and depressed earnings in 2017 as a result of significant weather events (two Hurricanes and an Earthquake), IGI has grown premiums and earnings through consistent, organic international expansion.

Even more impressive than the Net Income / EPS growth is continual underwriting outperformance, with a 10-Year combined ratio of 86.4%, a level practically unheard of in the short-tail insurance industry. The current combined ratio of 74% is not a sustainable level, nonetheless it goes to show how IGI, unlike most insurers, has results that skew to the upside rather than the downside. A combined ratio is the loss ratio (the outlay / payout on a policy and any litigation costs and adjustment expenses) + the policy acquisition cost (broker fee + underwriting cost) divided by the net earned premium. A combined ratio in the 90-95% range is considered impressive, and < 90% practically unheard of for a continuous period. Pictured below is the combined ratio and gross written premiums, demonstrative of IGI’s ability to grow without sacrificing margins (if anything, it has been able to boost margins as underwriting in the U.S. is lucractive)

B) Balance Sheet Conservatism

i. Lack of Leverage

Nonetheless, I think the real gem is not the impressive income statement, but the hyper conservative balance sheet.

Unlike most insurers, IGI’s balance sheet is pristine as Billie Eilish’s A10’s. There’s no debt. It’s hard to find a direct comparison, but Fidelis $FIHL and Hamilton Global $HG, all use debt as a source of risk capital. Is there something wrong with this? Absolutely not. It juices the equity returns. Because $IGIC hasn’t done this yet, though, it possesses (wow that word looks wrong but is right) what I call the book value bazooka.

With likely Q2 book value in the range of $13 to $13.20 (even without my adjustments), if IGI falls 10% because earnings are beginning to decline, they can just lever the company up with expeditious share repurchases. While this is not entirely an accurate way to think of it, since each company has a different mix of insurance lines and also a different level of comfort in levering up, $FIHL supplements 18% of loss reserves with debt as capital, and $HG supplements 5% of loss reserves with debt as a form of capital (intentional repetition). By levering up a bit, this obviously improve returns for equity investors, but $IGIC, with its family-run management team, has not pulled this lever at all.

IGI is already sitting on substantial excess capital as evidence by the 50 cent ($22 Million) special dividend and fresh buyback authorization. A lot of investors are glued to IGI’s book value, but with such impressive growth ahead and a proven history of risk management, IGI would easily be able to tap the debt markets for even a small issuance of $35 Million (7% of loss reserves). If this $35 Million were used to repurchase shares at the current market price, at a 5% after-tax cost of debt it would improve EPS by at least 12 cents (mental math), and provide significant downside protection as only 5.1 Million shares are circulating.

This is really a case of glass half-full vs glass half-empty. You have some names operating at a P/E of 6-8x, but they have already tapped the debt markets out, are 1.5x-2x book (think Everest or Renaissance), and if they were to further lever up the fixed income investors would stage a hunger strike. Everest, especially, knows this, which is why during the earnings call they sheepishly announced they repurchased at most 0.25% of the outstanding shares, and that they enjoy being a dividend name. Why settle for Bronze if you can go for Gold?

IGI is already at an industry low multiple, aside from the venereal disease known as James River, and if they were to pull even a third of the shenaniganry everyone else has pulled to lever up, IGI would end up purchasing a ridiculous amount of the float and boost the P/E to the high fours, if not better.

ii) Limited Interest Rate Risk

If you thought IGI’s balance sheet was conservative, boy oh boy do I have some extra news for you.

IGI, ever cautious, keeps 26% of its $1.151 Billion portfolio in cash and short-term time deposits, and another 70% in investment grade bonds. The duration of the bond portfolio is just 3.1 years, and the blended investment yield of the entire investment portfolio is 4.2%, a level unmatched among peers.

IGI’s conservative positioning made it an extreme beneficiary of higher for longer, and with $82.5 Million in fixed income coming due in 2024 and $150.9 Million coming due in 2025, IGI has the optionality to push out duration and lock in the highest rates in decades. Waleed Jabsheh, on the most recent conference call, mentioned IGI will begin increasing the duration of the portfolio this quarter. Unlike many insurers like Fidelis who was left holding the bag on 10-Year notes at 1% of $HRTG stuck with 2% munis, IGI’s short duration portfolio eliminated most interest rate risk, which is important as the entire fixed income portfolio is held as Available for Sale.

This is an important distinction from banks, who hold most of their assets as held-to-maturity. What this means for IGI is each quarter, the fixed income portfolio is marked-to-marker, meaning that if yields increased and bonds went down, net investment income is dinked, and if yields decreased and bonds went up, net investment income and EPS benefits.

As of 2023, IGI had $789 Million of fixed income investments, but the carrying value was only $765 Million (a $24 Million gap), as interest rates obviously increased from the time IGI bought the bonds, and thus the bonds trade below par. This directly impacts book value per share, as the bonds are marked at $765 and not $789. Nonetheless, within 4 or 5 years, as the bonds mature, this gap will close. IGI can either sell the bonds now and purchase higher yielding ones, boosting investment income, or hang on, and as the marks improve net investment income will improve. Either way, they are getting that $24 Million back.

With a portfolio duration of just 3 years, I think it’s acceptable counting that $24 Million in phantom book value. With 44 Million shares, another 24 Million in equity impacts book by +$0.54. More on that later.

More importantly, IGI is in a win-win situation.

Rates up? More free money. Rates down to 3%? Do you really think the GARP squad will allow IGI to remain at 5x or that IGI’s astute management team won’t tap the debt markets and lever up?

This is the opposite of being between a rock and a hard place, this is more of heads I’m going on a date, tails I’m going on a date and she smokes cigs and listens to Lana Del Rey. Hard to lose.

The below screenshot highlights the differential between the book cost of the fixed income portfolio, $789 Million, and the fair value, $765 Million. Also interesting to see they have a small equity portfolio that is humming along.

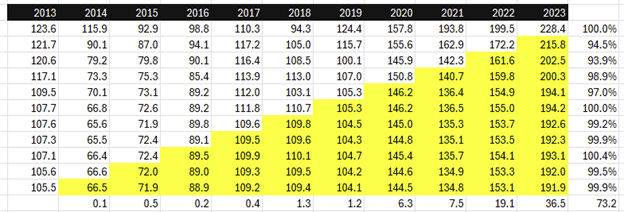

C) Historical Loss Reserves Continually Prove Conservative

Now this is the fun part. You guessed it, more conservatism. As with all insurers, IGI needs to estimate policy losses, more frequently referred to as claims, upon writing the policy. You can never know exactly what the loss will be, so you put out a rough estimate and update it as time goes by. Some insurers, such as an insurer that conveniently rhymes with “Thames River” or “Blinken National” are known for coming up with an initial estimate while under the influence of substances, and then 3-5 years later they come out and say “oopsies, we actually owe $500 Million more than we thought, kiss that share buyback goodbye” and the shareholders usually have a meltdown, but still somehow approve that executive compensation package.

This is less of an issue for IGI, because as mentioned before short-tail policies are less likely to surprise as time goes by. Nonetheless, in keeping with the cautious tradition, IGI has continually overestimated losses in the initial period, and performs beneficial adjustments as time goes by.

Because you can’t update previous earnings reports in any industry, when you lower your loss estimates, the differential is counted as a gain immediately. In the first quarter of 2024, IGI recorded a $22 Million positive adjustment. In fact, for every loss year in the last decade aside from 2017 and 2018, IGI has continuously overestimated losses, leading to pleasant, positive surprises.

For example, in 2013, they initially estimated losses of $123.6 Million. Claims ended up totally just $105.5 Million. That means they really made $18.1 Million more in that period than they thought they did. In 2014, they initially estimated $115.9 Million. 9 years later, that estimate declined to $66.6 Million. Kaching! Another $49.3 Million in bonus profit.

Obviously, as IGI gets more and more advanced as an insurer, their loss estimates becomes more accurate. In 2017, losses were initially estimated at $110.3 Million, and today are estimated at $109.6 Million. It was a busy catastrophe year with hurricanes and earthquakes, so IGI did not seem to have any “bonus” profit. For 2018, initial estimates have increased from $94.3 Million to $110.7 Million.

The overall trend, however, is extremely positive. As shown below, the cumulative overestimates for the years 2013-2023 are +$186.8 Million, and if the future is anything similar to the past, I estimate there is at least $73.2 Million in beneficial adjustments.

In Q1, $22.2 in “Prior Year Favorable Development” was recorded, so $51 Million (once again a very rough estimate) remains.

The yellow values, the estimates, are simply based off previous year’s trends. Since I only have 10-Year loss data for 2013, the most recent years follow that pattern. However, recent year loss estimates seem to have been even off by a magnitude larger than 2013, so hopefully there is more than $51 Million in remaining estimates to be converted into earnings.

Once again, this all comes back to the main theme of IGI’s conservatism, and glass half-full vs half-empty. IGI is operating around a 5.2x P/E and 1.15x P/TBV, but it’s past earnings seem to be consistently understated because the management team demands ultra-conservative loss estimates at first, and gradually reduces these estimates as they gain more clarity. Would you rather have “Do Not Pass Go, Go Directly to Jail” or “Bank Error In Your Favor”?

D) Cluseau, The “Mental Gymnast”

Equity was $557.2 Million as of Q1 2024 (inclusive of the 50 cent dividend declaration) translating into book value of $12.58 a share (44.3 Million shares outstanding).

Getting a bit mental gymnast-y here, but if we add in the $29.8 Million of unrealized bond losses as of Q1 2024 (which the company will earn back within the next 4 years), $51.0 Million of loss overestimates, and strip out the $11.8 Million liability for the remaining 1 Million warrant shares, we get total equity of $649.8 Million.

To be on the conservative side, let’s assume the 1,012,500 “earnout” shares that vest if $IGIC closes about $15.25 vest today, as well as 1,026,650 restricted stock units for the management employees.

$649.8 / (44,300,000 + 1,012,500 + 1,026,650) = $14.02 Book Value Per Share.

This involves a lot of mental gymnastics, but I do think there is a strong case loss estimates are overstated, it’s clear the company will earn the unrealized bond losses back as time goes on, and the warrant liability isn’t a real liability and I assume IGI will at one point close above $15.25 within the next three years, so those earnout shares as well as restricted stock units will eventually vest.

At Cluseau Mental Gymnast adjusted book value of $14.02 a share, $IGIC is just 1.07x P/TBV. Without these adjustments, it is closer to 1.15x.

It’s impossible to tell whether loss estimates will be reduced and the magnitude of any releases, but as of the last call, releases are expected to continue.

E) Adjusted Income Statement

As with all models, this is entirely make-believe.

Nonetheless, I “smoothed” out IGI’s earnings by taking the prior year developments (the change to previous years loss estimates), and simply averaging the effect and applying it to all quarters. I also applied this approach to the unrealized bond losses. At the end of the day, IGI intends on holding its fixed income portfolio to maturity, if interest rates go up and the bond portfolio is marked lower, or if rates go down the bond portfolio is marked higher. If IGI holds the bonds for the next 3-4 years, the end result is exactly the same.

For example, without the loss adjustments or fixed income appreciate in Q1, “core” EPS in Q1 would’ve been only $0.42. On the flip side, in Q2 and Q4 of 2022, EPS would’ve been much higher.

By stripping out sudden fixed income or loss adjustment moves, averaging (straight-lining them), and applying them to all periods, we get a much better view of how IGI is performing.

In the most recent quarter, they reported 89 cents of “core EPS”, but straight-lining fixed income performance and loss adjustments would’ve resulted in 71 cents EPS. Next quarter, I estimate raw EPS without any prior year adjustments to be around 57 cents.

Of course, over the past 9 quarters IGI has made a positive adjustment to previous loss estimates of $11 Million a quarter on average, so if you straightline that to Q2, “real earnings” are closer to 86 cents a share. This is an extremely crude model, but it should hopefully help illustrate how IGI’s conservatism frequently leads to current earnings being understated, because the company overestimates losses in the current quarter, and winds these estimates down in future quarters, thus leading to higher future earnings at the expense of the current quarter.

I hate modelling. I don’t know if any of this is accurate. All just a wild guess one way or another. Anyone who tells you they can model hurricanes, earthquakes, and earnings to the T is either lying to you, lying to themselves, or hasn’t touched ground grass (not “grass”) in months. Sorry to break it to you, but thems the breaks.

Anyways, my model has this year’s “adjusted” earnings at $3.25, but my mental number is closer to $3.00

The consensus estimate is $2.95 this year, but there’s only one equity research guy covering $IGIC. My actual guess for Q2 earnings is $0.72. I’d be happy with that.

6. Industry Relative Comparison / Absolute Analysis

IGI is significantly cheaper than peers. I dislike using the word cheap since it reminds me of that rhino pill I once purchased at a gas station, but whenever someone says “deep value” it reminds me of the time I wiped out on a bicycle and almost cut my foot off. More on that another time.

IGI is likely cheaper than all of its competitors due to the:

Low Institutional Ownership – With such a small float, why bother?

Limited Institutional Coverage – Only bank to cover is RBC

‘Twas a DESPAC

Middle Eastern Roots

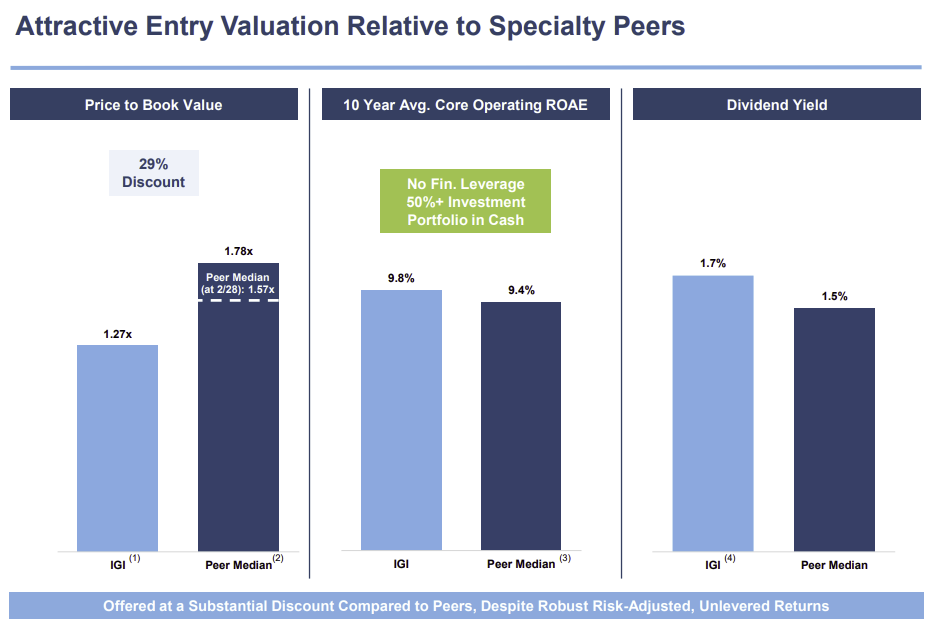

IGI trades at a significantly lower P/E / P/TBV than competitors, which is especially interesting given its consistent earnings history, conservatively positioned balance sheet, and high invested management team which has driven industry shattering metrics.

It’s hard to find direct comparisons to peers, so my comp set consists of:

ACGL – Broad array of life insurance, property insurance, reinsurance

HIG – Property insurance, financial products

SKWD – Business insurance

KMPR – Property, life, health

FIHL – More accurate comparison, marine, reinsurance, etc

Issue with FIHL (I still own it), is the company is not independent and an MGU (managing general underwriter) actually writes FIHL’s policies

HG – More accurate comparison, general business lines, reinsurance

Issue with HG is the underwriting is mediocre, pretty much all the earnings come from HG’s investment in a Two Sigma fund

IGI ranks near the bottom of the pack on a P/E basis and a P/TBV basis. As previously mentioned, all of IGI’s competitors use debt as a form of risk capital, if IGI were to borrow, they would likely be able to lever up, juice earnings, and trade at a higher multiple and thus a premium to book.

IGI is at the top of the pack on Return on Common Equity. KMPR was not profitable last year, and thus excluded. While the 28.4% ROE IGI put up last year is likely unstainable, it has been operating in the mid 20s for the past three years, and of course, if it were to lever up, would likely be able to sustain such levels. The 10-Year return on equity for IGI is 14.5%, significantly above the average 10% for most insurers.

IGI leads the pack with an incredible combined ratio of 77%. Once again, these levels are likely unsustainable, but the 10-Year combined ratio of 86.4% is still significantly better than the industry, and even better than most peers in 2023 (which was considered a low catastrophe year).

The bottom line is, despite IGI’s conservative, consistent growth, impressive capital returns built on-top of a clean balance sheet, and significant management alignment, it still trades at a significant discount relative to peers, and the larger market.

Will IGI be able to sustain 2023 levels? No. However, significant growth prospects in the U.S. construction liability, energy, and even E&S lines offers substantial opportunities for further expansion, and unlike Fidelis, HG, and most of IGI’s peers, IGI has significant excess capital that allows it to comfortably pour its incredible earnings into repurchasing its own stock.

At just 1.15x book, IGI has downside protection as it makes even more sense to repurchase equity below book, especially given the fact IGI has operated with no leverage for years, and will thus have an easier time tapping the credit markets than highly indebted names with significant earnings fluctuations.

7. Growth Avenues

The growth avenues for IGI are:

Further expansion into the U.S. Short Tail market

Construction, Energy, E&S (Compete with Kinsale)

Develop the reinsurance arm to take advantage of the hard market

Use Llyod’s Box to “make friends”, gain market color, boost distribution through a respected venue

IGI is well aware of these avenues, and is concentrating its efforts to capitalize on the above opportunities.

I am very pleased they mentioned capital management, but even more pleased they mentioned E&S lines. Kinsale Capital has been outclassing clunky, slow-to-adapt, insurers particularly in Excess and Surplus lines in the United States. Could IGI become the one outsider to give Kinsale a run for their money? The market certainly doesn’t seem to think so, but if there’s one thing IGI has demonstrated in the last decade, it’s that it somehow finds a way to weasel its way in and dust competitors.

By comparison, KNSL, which has been growing U.S. Net Written Premiums by 38% a year over the last 3 years, trades at a P/E of 29x and a P/TBV of 7.8x. For reference, IGI has grown U.S. premiums by above 114% a year over the last 3 years, and has a P/E of 5.2x and a P/TBV of 1.15x.

8. Risks

The main risk to IGI is catastrophe loss. In recent years, the largest single event catastrophe losses have been

Although IGI is currently rolling the dough to the tune of $120 Million a year, a catastrophe still has the power to spoil earnings.

This year, I think the Dubai Flooding in Q2, and Hurricane Beryl in Q3, may pose a threat. I do not know the geographic distribution of IGI’s Caribbean exposure.

Aside from the obvious catastrophe risk, sudden loss adjustments to previous years, or a cessation of positive developments could also pose an issue. Right now, I think everyone expects IGI to continue outperforming and surprising with prior year adjustments. If this stops, a crucial tailwind to earnings will be removed.

Finally, accounting fraud? IGI’s auditor is E&Y. I’ve never liked E&Y. In my opinion, everytime a sizable fraud is uncovered (Wirecard), it’s always somehow E&Y.

9. Why (I believe) $IGIC Isn’t a Value Trap

I think IGI’s significant insider alignment, low valuation, and conservative management style with a proven track record of expansion make it attractive. I think IGI’s consistent history of capital returns preclude it from becoming a value trap.

Unlike most value traps like $AMCX or pretty much any regional bank, IGI has shown zero hesitation towards emptying the clip, reloading, and then emptying the clip again on share repurchases.

Every decision they have made has proven itself to be prescient and ahead of the curve in terms of understanding what their stock was worth.

At $7, they went bananas on the buyback, and at $10 they wisely shifted to taking out 16.5 Million warrants to ensure upside wasn’t capped.

After paying a special dividend, they once again surprised by hiking the regular dividend, and then announcing 525k shares were taken out in the second quarter, and reinforcing the remaining 475k authorization by an additional 2.5 Million shares.

If the market doesn’t want to value IGI at its potential, or even at levels similar to peers, IGI is willing to keep slamming the buyback until the market agrees.

Not to mention, this isn’t a situation where the CEO / Management Team is happy to buy back but doesn’t have any of their own skin in the game. It’s one thing when Lumen or Charter or essentially any other company with insiders parachuting out the emergency exit announces a “token” buyback. It’s another when the management team is a family that started from nothing. Wasef Jabsheh and his sons built this company from the ground up, and haven’t sold a share since going public.

With ownership of $225 Million (and overall C-Suite executive compensation of just $9 Million, $6 Million in cash, $3 Million in employee shares), the Jabsheh’s understand that doing the right thing for all shareholders is what will make them the most money, and are sufficiently incentivized to keep doing the right thing.

Pay special dividends, repurchase your stock, expand the business, don’t grift! They have made the rounds at investor relations conferences and spread the word. Institutions may have overlooked them due to a lack of liquidity / float, but this only make the buyback more powerful.

What’s a fair value for IGI? I’m really not sure. You have a company around $15 with $3 in earnings, a propensity to return it to shareholders, and perhaps the cleanest balance sheet I’ve seen in the insurance industry. If you didn’t know the price, you might guess $18. Maybe $21. It’s hard to come up with a “serious target” for a name that traded at essentially 3.5x for two years before exploding 80% higher.

What I do know is that the management team treats the shareholders like a partner. There may be fat years and there may be lean years, but IGI has consistently weathered the storms well (pun), vastly outperformed peers on an underwriting basis (combined ratio) as well as overall expansion (gross written premiums), and most importantly prioritized shareholder returns by returning the bulk of earnings through share repurchases and special dividends.

Is a business of this quality, with its pristine balance sheet, strong capital returns, and conservative and aligned insiders really worth only 5.2x forward earnings and 15% over book? In a world where overpaid executives like mid-level “Chief People Officers” rush to cleveland-steam their large cap stock options onto the open market faster than a Dubai Sheik on an Eastern European girl after the second wave of quaker oats hits, in a world of 50’s, IGI is a beautiful 5.

10. Position and Conclusion

Long 78,000 shares at 12.32.

Once again, not advice.