$IGIC - The Little Insurer that Could

Diamond out in the open, or Manifestation of my Low IQ - You Decide

Legal Disclaimer:

This is not investment advice. The opinions express herein are likely uninformed, and solely the opinions of a guy pretending to be Chief Inspector Cluseau. You would be a fool to base investments off a guy impersonator a decades old movie online. Always consult a financial advisor / tax advisor before making investment decisions. By reading this article, you agree to hold harmless and indemnify the author (me), from your conduct relating to this article, including, but not limited to, trading decisions that result from your reading of this article. Furthermore, by reading, you acknowledge that the opinions herein are not investment advice (they are opinions, duh), and in no way constitute financial advice.

This entire article is transposed from my Twitter.

Trade #18: "Late is better than never"

Sector: Insurance LONG International General Insurance Holdings ($IGIC)

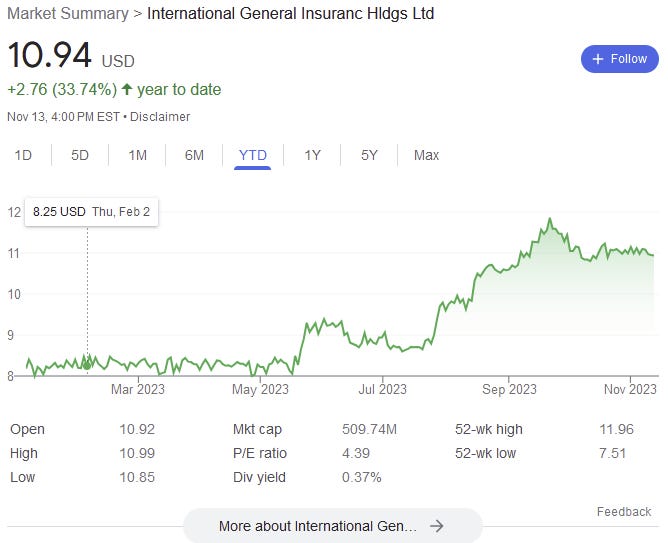

23,500 Shares $11.00

Current Price: $10.94

EOY 2023 Target: $13.01

EOY 2024 Target: $17.38

Disclaimer: Not financial advice. Consult a financial advisor before any investing decisions. High degree of risk in any investment. Conduct extensive research before making an investment.

Here's what you perhaps have been waiting for: You've heard of Elf on Shelf, Bond on a Blonde, Customer's Bancorp, Genie Energy, Bitwise 10, etc.

But, have you heard of IGIC? Probably not, and neither has Wall Street. Not only does Google incorrectly believe $IGIC is headquartered in Jordan, Bloomberg doesn't even have financials on it. More on that, later.

International General Insurance Holdings is an International Insurer (who would've thought) operating in all "short-tail" and "long-tail" segments.

Founded by Wasef Jabsheh, and his sons Waleed and Hatem in 2003, IGIC has grown from an regional, forgettable name, to an International Powerhouse.

$IGIC took an unusual road to becoming a public company, it merged with Tiberius Acquisition Corps in early 2020, and was promptly left for dead when COVID hit.

Not only has it roared back with 20% annual growth in premiums earned since 2018, it has grown earnings an impressive 194% from 2020 to 2022, in fact, it has gone from earning $0.59 EPS in 2020 to earning $0.83 in Q3 of 2023 alone. According to my simple math, it is on track for $2.70 this year, and $3.30 next year.

With growing headcount due to expansions in Malaysia, Southeast Asia, and mainland Europe, earnings are set for a fresh record in Q3 (at least on a YOY basis). $IGIC has a proven track record of excellent risk management, not only exemplified through its limited duration corporate bond portfolio (40% of the portfolio matures by 2025) and industry leading combined ratio (73.5%), which is also a record for the company itself, it's loss estimates have continually proved to be too conservative (may discuss this further below).

Now Cluseau, you might be saying, where's the alpha? Why the discount? Here are a few thoughts:

1. Liquidity - With average volume just shy of $750k, most funds won't touch it.

2. IGICphobia - Data providers seem to think it is headquarter in Jordan. Wrong. Also missing financials.

3. Risk - Despite its middle eastern roots, 81% of IGIC's brokers are London Based, and nearly half of its annual revenue comes from NA and UK alone…. (weee ooo weee)

Now, finally, could this be a value trap? Could be. I have an anecdotal story on corporate governance. There are 1) good companies, 2) bad companies, and 3) good companies run by bad people.

$AMCX is 3. The new CEO, who happens to be the wife of the controlling shareholder, just called April 2024 Notes with a 5% Coupon with the 1-Month at 5.4%. Lol.

$GNE is 1. The CEO intelligently called $GNE-PRA to save an extra hundred thousand in dividends. It's actually what got me interested in the first place.

I believe $IGIC is also in category 1.

Here's why.

Prior to the bank meltdown in April, $IGIC actively bought back 2 Million shares at $8, and another 300,000 in Q2 to stabilize the stock. As the company has edged higher, the company wisely bought back all outstanding $11.5 Warrants (expiring in 2025) at $0.95. The only reason you would spend $9 Million on expiring warrants, is if you believed the fair value of the company is higher.

Lastly, Wasef and his sons own about 34% of the company, with Oman's Investment Corporation and affiliated entities owning another 9% I think.

Not only does he own 34%, he has an additional 3 Million in "earnout" shares. These are outstanding shares, that will be cancelled by 2028, (not like silly options given to obese American executives), literal shares, that will be removed and cancelled if the price does not hit performance targets ranging from $11.50 to $15.

Tell me that isn't a motivator.

To summarize, since if your attention span is anything like mine (only reason I could write this much is I am very inebriated right now - also just realized I forgot to discuss book value lol), $IGIC is a growth name trading at a distressed multiple. With book value at $10.91 (just three cents shy of the current price), buybacks, a P/E of 5 and 2024 estimate P/E of 4, and insiders holding 30 Million shares along with the fact Waleed needs to get the stock to $15 by 2028 to ensure his "earn out" shares aren't cancelled, it's not hard to see why this stock has me interested.

One day, maybe I will write a substack since this is more of a ramble. I own 23.5k, and will probably try to hit 30k tomorrow before earnings. I am looking for $0.65 tomorrow, although Q3 is usually a lower quarter so it could be anywhere from $0.35 to $0.75 considering last quarter was $0.88.

This is not financial advice. I am drunk. Consult a financial advisor before any decisions.