45% Discount to NAV - BITW - Trap or Compelling Situation? You Decide!

My deranged thoughts - After the Disclaimer, of Course

Substack is incompetent. My edits were not getting sent out. I reposted to correct the discount to NAV.

Before we get down and dirty, please read the below disclaimer. You are not allowed to continue reading unless you read this disclaimer…

Legal Disclaimer:

This is not investment advice. The opinions express herein are likely uninformed, and solely the opinions of a guy pretending to be Chief Inspector Cluseau. You would be a fool to base investments, and in particular trading a Pink Sheet listing, which carries higher risk than pretty much anything else, off an article written by an autistic man online. This is not a solicitation to buy or sell securities. Always consult a financial advisor / tax advisor before making investment decisions. By reading this article, you agree to hold harmless and indemnify the author (me), from your conduct relating to this article, including, but not limited to, trading decisions that result from your reading of this article. Furthermore, by reading, you acknowledge that the opinions herein are not investment advice (they are opinions, duh), and in no way constitute financial advice. Lastly, Pink Sheet listings carry extreme liquidity risk, as do cryptocurrency, please read prospectuses before engaging in any investment.

Once sentence summary for those of you who hate reading (me too): $BITW trades at $12.50, has a nav close to $23. If you want exposure to crypto, you can get it a 46% off, with a potentially 80% instant gain if the fund becomes an ETF, issues a partial tender offer, or winds down. Not advice.

The Beef

You’ve heard of Elf on a Shelf. You’ve heard of Bond on a Blonde. But have you heard of the Bitwise Crypto 10 Fund? Probably not…

Outline:

Introduction

Bitcoin ETF Pending Approval

History of BITW and Holdings Composition

Legal / Regulatory Tailwinds

My Position

Introduction / Bitcoin ETF News

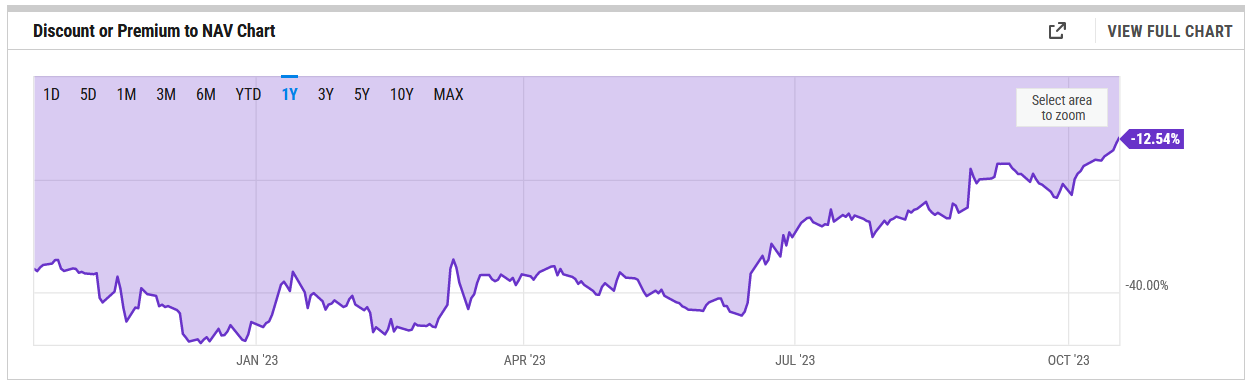

Crypto ETFs seem to be all the rage. Just a few days ago, the SEC declined to file an appeal against Blackrock’s Spot Bitcoin ETF Application. Although this doesn’t explicity approve the ETF, markets seem to be implying an 80-90% chance Grayscale, Blackrock, etc get their applications approved, as the GBTC and ETHE discounts to NAV (Net Asset Value) have narrowed from greater than 66% a few years ago to just 12% (nearly 70% upside in the last three months). See graph below of $GBTC

Interestingly, $GBTC could’ve been buying back shares at 50% discount, but they dragged their feet, instead claiming that an ETF would be a better option. This was a brilliant move, as it allowed them to look like the good guys, while also milking 2% on $17 Billion, nearly $340 Million a year or a Million a day.

I’m getting distracted here.

The special situations investors have piled into GBTC, and ETHE, the two most prominent funds, in anticipation of imminent ETF approval. If ETF approval comes, these guys hit pay day (assuming they have properly hedged their crypto exposure).

Now, as all of you know, I love trouble.

I’d take the blonde goth girl with black lipstick, family issues, clogs, and maybe even a socialist (I can fix her), over the put together, plain jane, standard dyed blonde pretty much every day.

Introducing (drumroll please…….) $BITW, The Bitwise Crypto 10 Index Fund.

History of BITW and Holdings Composition

The fund began in 2018, and became publicly tradeable in late 2020, initially trading at premiums as high as 100% as investors rushed for exposure to the sector.

$BITW, to our advantage, and to the disadvantage of many insitutional investors, is Pink Sheet listed, which, if you don’t know, is like a step down from being OTC. If OTC Main Board Listings are HIV, Pink Sheets are fully blown AIDS. Most brokerages, such as IBKR, require additional permissions just to touch this kind of stuff. It’s dangerous.

The Bitwise Crypto 10 Index Fund has just shy of half a billion in AUM, with a 2.5% fee structure. Slightly higher than GBTC at 2%, and BITO, which is futures based, at 0.95%.

It holds the top 10 cryptocurrencies in market-cap weighted weight, with Bitcoin and Ethereum comprising just over 90%, which Litecoin, Bitcoin Cash, Cardano, Solana, Ripple (lol) making up about 10%.

Due to $BITW being Pink Sheet listed (and the slightly confusing fact it owns 10 different cryptos instead of just 1), many of the traditional screeners such as Bloomberg, CEF Connect, Ycharts, do not cover it. As such, practically no one is aware of its existence.

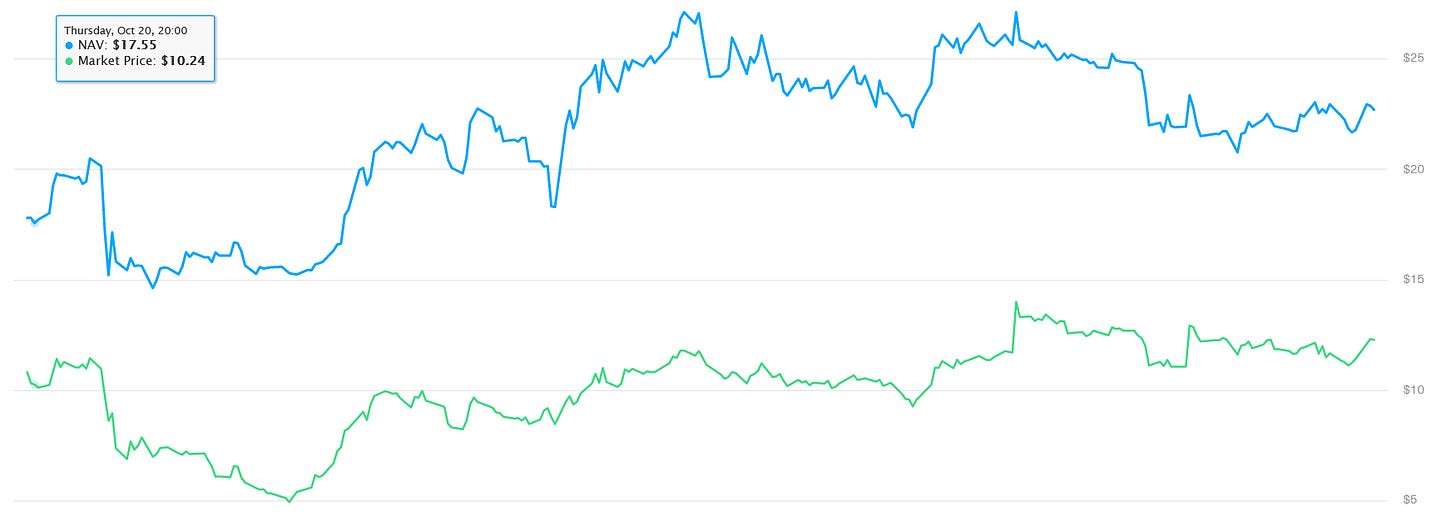

As of right now, BITW has an intraday NAV of $22.93, yet trades at just $12.50. Graph of last year below

In fact, the current discount of 46% is larger than the 40% approximate discount on this day last year.

The thesis is simple, $BITW is unknown and overlooked. Why am I sharing with you? I’ve already bought my position, and have self-control rules (lol) to prevent myself from making an Pink Sheet listed name more than 2% of my portfolio.

Legal / Regulatory Tailwinds and Potential Events

If Bitcoin / Ethereum spot ETFs are immediately approved, Bitwise should move to convert its traditional products (1 cryptocurrency only) into ETF structures. Will they move for BITW? Hard to say, since the SEC has not commented on multi-cryptocurrency ETFs. What I do believe, however, is that shareholder pressure will mount for conversion, or at the very least, to convert the fund to Bitcoin / Ethereum only, to fast-track approval, OR, for a tender offer to be made to close the discount, similar to the action the good guys like Boaz Weinstein commonly take.

The reason I think litigation risk is a major benefit in this special situation is that the BITW Fund is small. Will annual fees of $9 Million, and likely net income closer to $3 or $4 Million after expenses, Bitwise will be hesistant to fight shareholders as the cost of legal defense will destroy any potential for profit.

For example, Grayscale was pulling in nearly half a billion in fees annually, so it made sense for them to go to war with shareholders. For Bitwise, it does not.

Conclusion and My Position

With the discount to NAV near the highest point in 12 months, and my desire to have crypto exposure, I own about 9,600 shares of $BITW. I will be open to purchasing an additional $40,000 if the discount widens to 50%, and will likely reduce my position to $80,000 is the discount narrows to 33%.

My $120,000 purchase is backed by $220,000 in underlying cryptocurrency. Although there are numerous risks here, primarily (please read):

Cryptocurrency goes down

Fidelity, the custodain of the digital assets, is hacked and we are left with $0

Gary Gensler tries to mogg everyone and goes to war again (don’t see how this is possible)

Bitwise goes full authoritarian and decides it is worth $10 Million in legal expenses to preserve $9 Million in fees

Spread widens

I think these risks are outweighed by the chance an annoucement is made:

Tender Offer

Closing of the Fund

Immediate Conversion to an ETF

and I receive a $100,000 instant payday.

If yougive this a 20% chance of becoming a $0 due to some crazy events, an 40% chance nothing happens, and a 40% chance something good happens, it clearly becomes a very compelling investment. The $0.30 in annual fees on the $12.50 a share price is outweighed by the greater than $10 a share discount that may well be captured in a instant if good news occurs.

Not trying to brag here, but at my size I’m ok with not hedging the crypto exposure and just being long $BITW. Obviously, please make sure you understand all potential risks, and only do what you are comfortable with. A lot needs to go right for me to collect that 80% discount…

Open to any questions, thoughts, and criticism.

Hope you enjoyed this writeup!

put some 200$ on this badass. Some exit liquidity for anyone who's willing...